The data centre securitization market is just beginning in Europe, with Vantage marketing the first deal following its 2024 debut trade in the UK.

The €720m Vantage Data Centers Germany 2025-1 securitization is an inflection point for Europe, after which the market will have decided whether this will not just be a workable asset class, but a flourishing one.

With the artificial intelligence sector set to grow rapidly, there is a huge need for data centres. But they will need capital investment.

The US has already proven that securitization is a credible route for financing data centres. In fact, the market is flourishing, with 10 deals so far this year and issuance already at $4.7bn, according to Finsight. It was only as recently as 2018 that the US market consisted of two deals, totalling $1.1bn.

Meanwhile, European securitization has struggled much more than its US counterpart since the 2008 financial crisis. Total euro issuance volumes were €244.9bn for 2024, less than a sixth of the US at €1,548.4bn, according to The Association for Financial Markets in Europe.

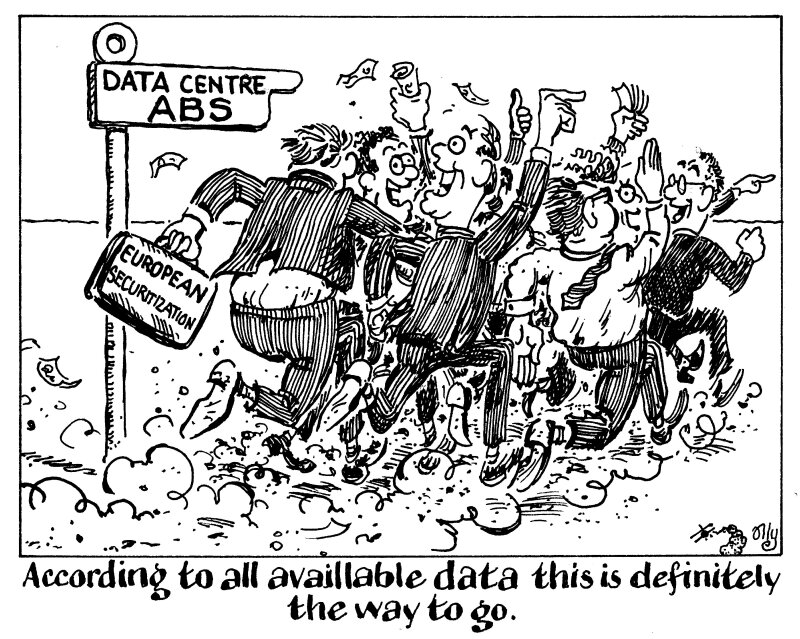

With such a large need for capital in the data centre sector, and with securitization already a proven way to raise it in the US, Europe has been handed a golden opportunity to not just develop a new asset class but to grow the credibility, relevance and size of its ABS market.

Issuers and investors must take this opportunity to level up European securitization.