Many in the European securitization market want regulators to ease up on them but the entire industry needs to stamp out sharp practice and police itself better if the rule makers are going to loosen the shackles.

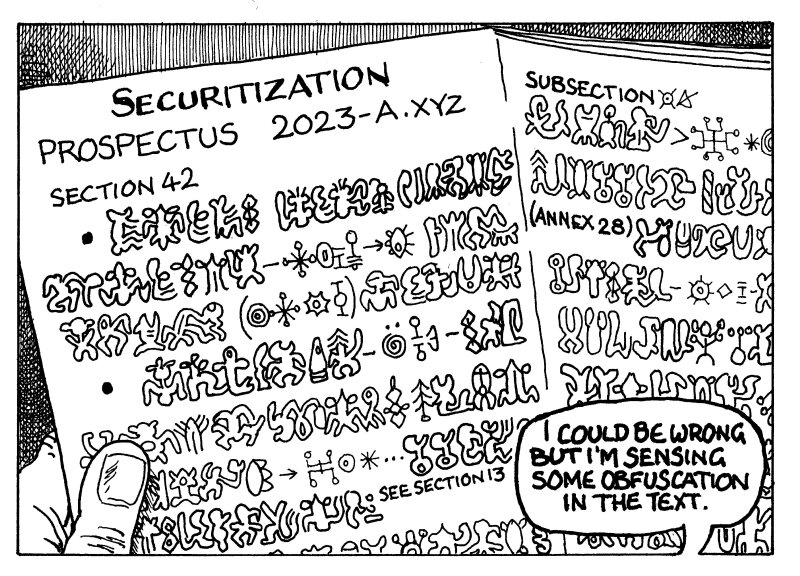

An example of the problem came up in research published this week by the Social Science Research Network, which found that originators obfuscate how low the quality of a securitization is by making their prospectuses harder to understand.

That behaviour had dropped off since the 2008 financial crisis, with investors punishing issuers for producing long prospectuses. By one measure used in the study, one standard deviation of complexity is worth 25bp. But a more subtle measure found investors are still letting issuers off for poor text readability.

Transparency is essential. Opaque products were, after all, what dragged securitization into the regulatory mire in the first place.

In September, the French and German finance ministers suggested some tweaks to the EU’s Capital Requirements Regime (CRR) could be on the way, to recognise that securitization markets are more liquid than they get credit for.

While impactful, modifications to the CRR are low hanging fruit, because they are backed by such strong evidence — most notably from the UK’s liability-driven investment (LDI) sell-off in the wake the government’s September 2022 mini-budget. While the supposedly liquid Gilt market froze, a quarter’s worth of securitization bids wanted in competition (BWIC) volume was traded in just three weeks.

It is not so easy to demonstrate the folly, overreaction and excess in other parts of Europe’s prudential regulation.

Consider the volume of credit work the rules require of investors. That can limit investors’ ability to look at deals during a sell-off like the LDI crisis and hence limit liquidity.

You cannot easily show the counterfactual that investors would have been more thorough after the financial crisis without the regulations compelling them to be so.

Therefore, the market needs to help itself. Regulators will know a baffling doorstop of a prospectus when they see one and it will give them nasty flashbacks of 2007 and 2008. They will then use the only tool they have to correct the problem: more rules.

If shrinking the rule book will make the securitization market a bigger place, more helpful to society, then originators need to shrink their prospectuses first.