Latest news

Latest news

New realm for ex-Natixis banker, as HSBC Innovation Bank hires

Patrick Wills has more than 14 years’ experience working at US bank

Manager establishing London-based European BSL CLO platform

More articles

More articles

-

London-based Revetas Capital Advisers has teamed up with Patron Capital Partners to invest up to EUR100 million ($121.8 million) in distressed real estate assets within the banking system of Central and Eastern Europe.

-

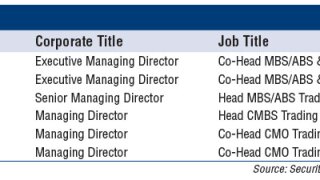

Gleacher & Company Securities, the broker/dealer arm of investment bank Gleacher & Co., has continued its senior-level hiring push.

-

The U.S. Securities and Exchange Commission has named Paul Beswick as the acting chief accountant in the SEC's Office of the Chief Accountant to serve in place of James Kroeker, who left the agency July 13.

-

Wells Fargo earmarked $669 million in the second quarter to honor growing requests that it repurchase bad loans.

-

Marcus Agius, the outgoing chairman of Barclays, suggested to employees in a memo that the U.K.’s bank’s dozen or so rivals named in connection with the scandal to manipulate the London Interbank Offered Rate will likely pay heavier penalties than the £290 million ($448.7 million) fine it received.

-

Andrea Enria, chairman of the European Banking Authority, is pressing to make the core Tier 1 ratio 9% requirement for banks permanent, though it was originally designed to create a temporary buffer.

-

Ireland’s National Asset Management Agency is planning to repay by the end of the month EUR 2 billion ($2.44 billion) of senior bonds issued to buy loans from the banks, provided NAMA has the cash on hand after the government ordered it to lend EUR3.06 billion ($3.72 billion) to the Irish Bank Resolution Corp., formerly Anglo Irish Bank.

-

The U.K. Council of Mortgage Lenders says it is “very unlikely” that the scandal involving alleged manipulation of the London Interbank Offered Rate will have any impact on British homeowners.

-

CBRE has hired Michael Atwell as head of capital markets for Central and Eastern Europe.