Latest news

Latest news

Borrowers take advantage of robust CLO demand to tighten leveraged loan pricing

New realm for ex-Natixis banker, as HSBC Innovation Bank hires

Manager reset the deal for the second time as the end of its reinvestment period approached

More articles

More articles

-

Strong investor demand supports further tightening, but small order sizes keep it gradual, say bankers

-

Managers welcome a softening in secondary loan prices but margins continue to be squeezed

-

Seven deals could be priced this week as spreads are expected to tighten further

-

Private equity sponsors are feeling the pain of a valuation mismatch. But an eager CLO market can help them as they alter their goals

-

Strong demand helps riskier deals get done, but mezz guidance widened

-

◆ Race for public solar ABS is on ◆ Senior noteholders to suffer CMBS losses for first time since 2008 ◆ CLOs jump tighter again

-

Spreads are expected to tighten further, but getting ahead of a wave of deals could help manager ramp the portfolio

-

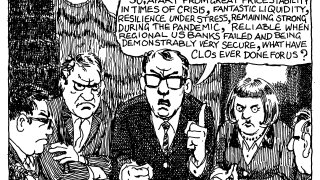

However well it does, the market cannot shake off its 'risky' tag

-

A few leveraged buyouts made CLO managers hopeful for more loan supply, but private equity still struggles with the valuation mismatch