Latest news

Latest news

Despite unfavourable equity arbitrage, CLO issuance continues at pace

Triple-A rated CLO spreads tighten at last and a template is established for European data centre ABS

Public versus private distinction scrapped for disclosure plus new, simplified templates for mature asset classes

More articles

More articles

-

Intermediate Capital Group will start a roadshow next week for its latest European CLO, St Paul’s CLO IV, with pricing set to be tighter than its CLO sold in November last year.

-

Prudential Investment Management and Credit Suisse Asset Management both priced deals early this week, as the pipeline continues to trickle on.

-

Wells Fargo and other banks are pressuring managers of the collateralized loan obligations they hold to restructure them to be Volcker-compliant, sometimes as a precondition to buying new deals from those managers, according to people familiar with the matter. Spokespeople at Wells were not able to comment by press time.

-

Exotix appoints global head of loans — RenCap continues equity sales drive with VP hire

-

LCM Asset Management hit the market with its first collateralized loan obligation of 2014, and the first to price since the ABS Vegas conference last week in Las Vegas.

-

Having the last laugh is satisfying — just ask Russia’s Siberian Coal Energy Co (Suek). The firm is on the verge of signing a hugely successful facility after almost all corners of the emerging market loan universe said that the deal would struggle because of its five year tenor — Suek’s third loan of this length since October 2011. The time has come for lenders to accept how things are, rather than grumbling about how they think they should be.

-

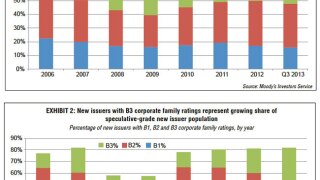

In 2014, the credit quality of new collateralized loan obligations will be strong, characterized by amortization in both the U.S. and Europe and by solid deal structures, a benign macroeconomic environment, and loosening credit in the U.S.

-

Dealogic league tables of total revenue transactions, full year 2013. Including Investment Banking, Debt Capital Markets, Equity Capital Markets, Mergers & Acquisitions and Syndicated Loan revenues.

-

Collateralized loan obligation professionals say regulators are beginning to come around to the sector, and that some sort of relief from the Volcker rule is now likely. [Updates previous article entitled "Volcker Would Cause $7 Bln In Bank CLO Losses"--LSTA]