Latest news

Latest news

January's ABS data center deals see tenant numbers drop but demand remains strong

Deals including some commercial mortgages expected to follow

Deal was priced 6bp tighter than most recent iteration of the asset class

More articles

More articles

-

Ford Credit Europe (FCE) has lined up leads for a new €610m German auto ABS deal from its Globaldrive shelf, the first European ABS deal to be announced this year.

-

The US marketplace lending space was forced to overcome a slew of obstacles in 2015, while the budding industry saw the entrance of institutional players to the game, in addition to a growing number of platforms tapping securitization. Meanwhile, in Europe, market players anticipate a maiden securitization in 2016, but a sensitive ABS market could pose problems. Sasha Padbidri and David Bell report.

-

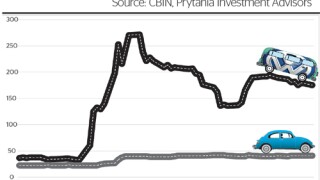

The auto industry will remember 2015 for the wrong reasons, but the resilience of the European auto ABS market during this time of turmoil points to the continuing importance of securitization for car makers, writes David Bell.

-

Competition among yield hungry Spanish banks lending to small and medium enterprises may be getting too hot too fast.

-

Volkswagen Financial Services (VWFS) has priced a R$1.09bn Brazilian auto ABS transaction, its third deal from its Driver Brasil shelf.

-

LIKE SEVERAL ITALIAN CORPORATES, THE country's export credit agency, the Sezione Speciale per l'Assicurazione del Credito all'Esportazione, has also used securitisation to raise funds at a rating above its own assumed level - in SACE's case, that of the sovereign.