As more banks use cash securitization to obtain capital relief, they will need to starting putting deals out earlier in the year, or will run into the familiar problem of oversupply in the ABS market.

The pipeline of full capital stack securitizations often takes until April to really get moving, because that suits banks' own timelines. But the result is a busy May, June, September and October, which can take a toll on order books.

In the last two years, by the end of October, the pace of supply has been such that spreads widened, particularly at the senior level, simply because investors could not keep up with everything being thrown at them.

A growing part of that supply is from banks offering full stack deals.

The sector has reached a size where the timetable does not make sense.

Investors are often crying out for some mezzanine paper in January and February. Oversubscription ratios reached double digits on some deals by specialist lenders this year.

Yet full cap stack bank issuers currently seem content to leave that window to those specialists, and to car finance issuers selling triple-As for funding.

The popularity among banks of using ABS for capital relief seems to be only increasing. Santander is the biggest issuer in Europe but others are also stepping up their programmes.

Santander priced a deal using German loans at the end of April, a Spanish deal earlier this month and it is now out with an Italian trade.

Meanwhile, Société Générale, BBVA and Mediobanca have all priced mezzanine bonds in recent weeks, while BNP Paribas is looking to follow next week.

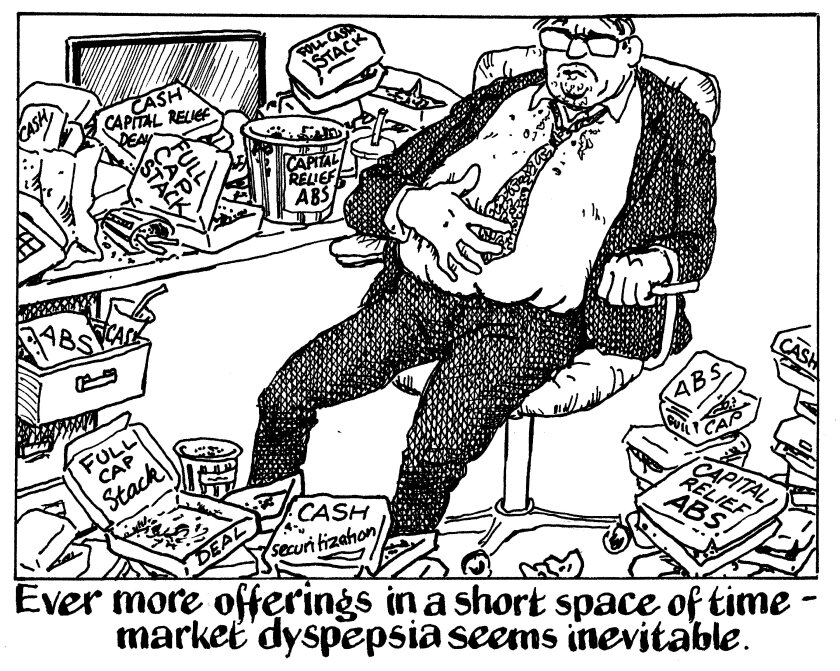

There has not been a hiccup this year and the tone certainly remains constructive, but history suggests that cramming more and more ABS deals into a short space of time can end in indigestion.

In addition, April's tricky market conditions illustrated how brief windows can get unexpectedly cramped, with Santander having to delay its German deal.

Banks, you're on to a good thing — but surely it makes sense to start earlier in 2026.