Home equity line of credit provider Figure took a courageous approach on its latest outing in the RMBS market, trying out a rare, mostly pre-funded structure in still tentative market conditions.

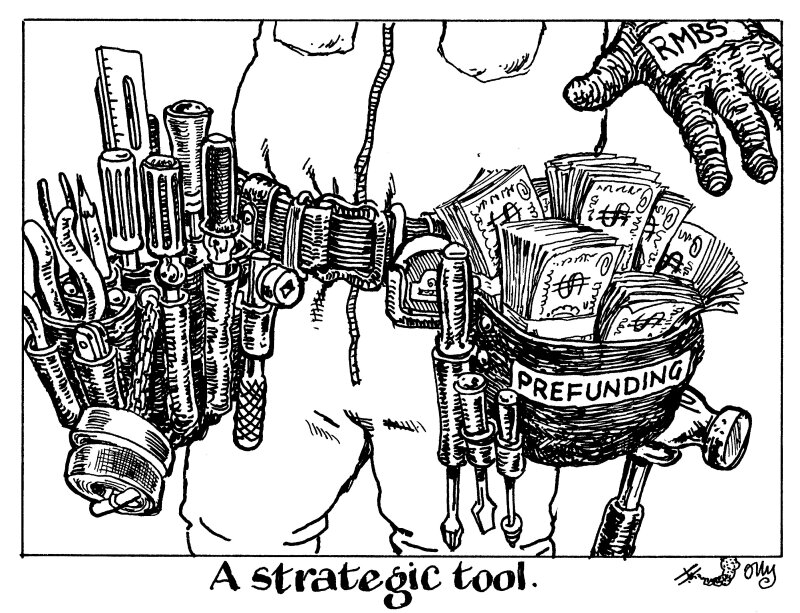

It paid off, with Figure finding healthy demand, and other RMBS issuers should look to emulate the technique as a strategic tool for those in the sector to use when navigating uncertain markets.

At the time of the $300m issuance last Friday, Figure had about $125m worth of loans as collateral in the deal, but the company raised an additional $175m that it will use to originate further Helocs that fit the credit box.

This deal showed how pre-funding structures give issuers the option to lock in execution conditions today, allowing issuers to price loans competitively knowing what their exit financing is.

Issuing with pre-funding allows issuers the ability to take advantage of issuance windows with favorable conditions, if deal economics work out for them.

That can make sense for certain situations and business models. Instead of waiting to have enough collateral to do a deal and risk worse execution, you can capitalize on better conditions now and obtain certainty on your financing to price loans.

In particular, this applies to regular issuers that can convince their investor base they will bring in high quality collateral into the deal. There is no shortage of those in the US RMBS.

In some ways, the fact that it was a Heloc provider that brought a deal of this type is not surprising, since these loans are revolving by nature. In many ways, they function like credit cards.

But pre-funding both builds on and differs from revolving securitization structures.

Revolvers are similar because investors are not certain of the collateral quality for future loans added. But unlike pre-funded deals, revolvers are usually fully backed by at least an equivalent amount of collateral at issuance.

While residential transition loan deals include some pre-funding in revolving structures, that is driven more by necessity. RTLs are fast paying, short term structures. Helocs, on the other hand, can be anywhere from five to 30 years long.

The RMBS market is naturally maturing, and any behavior that was common before the 2008 financial crisis can only return in a more disciplined, perhaps even tame fashion.

Issuers, however, should be encouraged by Figure’s success in applying pre-funding to longer-dated mortgage products.