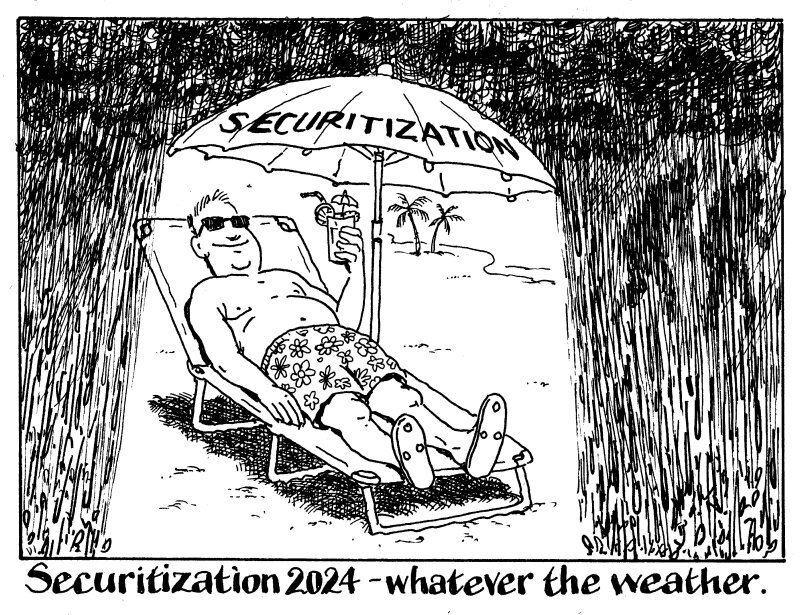

Reasons abound for optimism in European securitization in 2024 — regardless of whether or not what feels like the most predicted recession in history finally materialises next year.

The long trumpeted narrative that the end of central bank funding would mean a prime RMBS revival finally came good in 2023. From Lloyds to Leeds, UK banks and building societies dusted off their RMBS shelves and they were met by exuberant demand.

What a contrast to covered bonds, where bank treasurers have been running into name limits and investor saturation. It is no surprise, then, that issuers are looking to take full advantage of securitization.

Among them, Nationwide is revamping its RMBS issuance timetable for maximum speed and flexibility — an innovation that should make the asset class more competitive still.

Yet, conventional wisdom is still that securitization lags behind the broader markets. But the idea that it is the first market to shut up shop and the last to reopen is no more.

During the Gilt sell-off of September 2022, RMBS was among the most liquid asset classes in secondary. As much securitized paper changed hands through BWICs in three weeks as would be expected across a whole quarter.

After Silicon Valley Bank collapsed this year, the ABS market snapped back to life within weeks, when some were predicting a shutdown lasting more than a month.

All this despite UK mortgage originations drying up because of rising interest rates. It seems there has been a realisation that having asset backed investments can anchor portfolios through a storm.

And if the sun shines, 2024 could be the year for the first ever public European solar ABS. Stabilising swap rates could mean UK banks returning to dollar issuance and rising collateral originations would be a much needed boost in the non-bank market.

2024 should be a good year for securitization, whatever the weather.