Latest news

Latest news

PRA and FCA go much further than EU in loosening rules

Liberated issuers will still have to follow European regulations if they want to sell in EU

Citi prepares consumer ABS from Abound forward flow

More articles

More articles

-

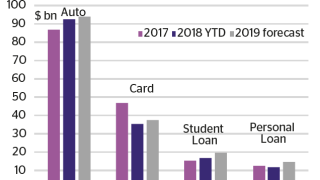

Consumer spending habits have changed beyond recognition since the financial crisis 10 years ago. US households are more wary of debt and are turning away from many of the traditional avenues of spending that have driven ABS markets for decades. While the market has come back since the depths of the crisis, securitization in 2019 is a different beast.

-

Once a big portion of global structured finance, non-agency RMBS has been a small part of the MBS market since 2008, in spite of a housing recovery in the US. Alexander Saeedy examines the outlook for a comeback of private label bonds in 2019.

-

The European Union’s new securitization regulations come into effect on January 1, a year after publication. Market participants hope they will help spark an industry revival, 10 years on from the global financial crisis. But lingering concerns could stall issuance of European ABS as 2019 gets under way.

-

Banca Carige has reduced its non-performing loan (NPL) book to €3.5bn a year ahead of schedule with a €964m NPL securitization, utilising a well tested structure that uses a state guarantee on the senior tranche.

-

The European Parliament and the European Council have reached an agreement on a set of measures to tackle non-performing loans in the banking sector, broadly backing the European Commission’s proposals from March.

-

With an eye to reducing prepayment speeds on Ginnie Mae mortgages, the U.S. Department of Veterans Affairs (VA) announced new rules on Friday that spelled out how the agency will broaden its crack down on predatory refinancing practices.

-

Following its debut £750m Sonia-linked covered bond issue in September, Lloyds has printed the first securitization linked to Sterling Overnight Index Average (Sonia) – Elland RMBS. The deal more than doubles the outstanding issuance in the format.

-

The Secured Overnight Financing Rate (Sofr), the chosen alternative to dollar Libor rates, has shown more volatility, spiking to an all-time high toward the end of last week before moving back down this week.

-

President Donald Trump nominated Mark Calabria, a well-known securitization sceptic, to head the Federal Housing Finance Agency (FHFA) — the body charged with regulating government-sponsored enterprises (GSEs) — on Wednesday.