Latest news

Latest news

New realm for ex-Natixis banker, as HSBC Innovation Bank hires

Patrick Wills has more than 14 years’ experience working at US bank

Manager establishing London-based European BSL CLO platform

More articles

More articles

-

The impact of coronavirus on economies has led to extraordinary help being granted to banks and their customers. But this brings the risk of problems on banks' balance sheets being hidden, according to William Coen, former secretary general of the Basel Committee on Banking Supervision.

-

Natixis promotes DCM bankers — Powell quits IFAD job — NatWest Markets makes Peberdy, Donaldson and Manwaring's positions permanent

-

The first CLO to comply with both diverging regimes in the UK and the EU has closed, marking a post-Brexit point of no return for the securitization market.

-

The European Parliament's Committee on Economic and Monetary Affairs (ECON) has voted through regulation to harmonise the secondary market for NPLs across Europe, pushing through a key stage of its Action Plan aimed at rebuilding the European economy post-pandemic.

-

Tom Rutledge, fixed income strategist at Magnetar Capital, has left the company to join Wapanda, a startup based in New York focused on the mobility industry.

-

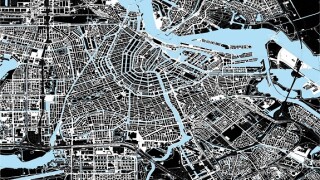

It’s been almost a year since a Dutch tax ruling sent CLO managers scurrying to Ireland to avoid a VAT charge. But with the changes coming into action in 2021, some CLO managers are leaving their vehicles in the Netherlands and taking their chances on a ruling from the supreme court.

-

A blue Senate is posing a new threat to the ABS market, as regulators and lawmakers are set to turn their focus to consumer protection. Sherrod Brown, a critic of big banks and a loud consumer rights advocate, is now favourite to chair the Senate Committee on Banking, Housing and Urban Affairs, which could lead to a stream of headline risks for lenders.

-

Onex Credit Partners has appointed Conor Daly to head its European CLO franchise, building out its capacity to tap into the European securitization market in 2021.

-

STS third-party verifier Prime Collateralised Securities (PCS) has hired Harry Noutsos as a managing director in market outreach.