-

Communications about capital markets issues like IPOs have to be true — but that does not make them meaningful

-

Housing is high on the agenda, with scope for disruption to RMBS and other markets

-

Private equity sponsors are feeling the pain of a valuation mismatch. But an eager CLO market can help them as they alter their goals

-

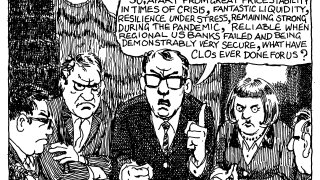

However well it does, the market cannot shake off its 'risky' tag

-

Spreads tighten as money chases assets but taking the easy money raises risks

-

It was the best of times, it was the worst of times to execute a deal mandate

-

Celebrating a CLO market driven by technicals is like praising a merry-go-round for its mileage

-

When it comes to monitoring comms, surely what’s good for the banking goose is good for the governmental gander

-

Investors want easy buys that bring diversity and yield

© 2026 GlobalCapital, Derivia Intelligence Limited, company number 15235970, 4 Bouverie Street, London, EC4Y 8AX. Part of the Delinian group. All rights reserved.

Accessibility | Terms of Use | Privacy Policy | Modern Slavery Statement | Event Participant Terms & Conditions

Cookies Settings