Latest news

Latest news

Borrowers take advantage of robust CLO demand to tighten leveraged loan pricing

New realm for ex-Natixis banker, as HSBC Innovation Bank hires

Manager reset the deal for the second time as the end of its reinvestment period approached

More articles

More articles

-

Against a backdrop of rising Libor rates, deteriorating loan covenants and strong corporate earnings, CLO participants in 2018 had to digest a host of mixed signals from the market. Investors and managers are cautiously eyeing a continued bull run as the sector comes to a late-cycle crossroads in 2019.

-

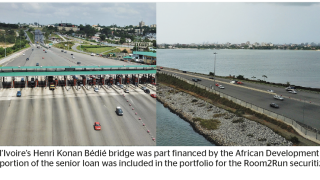

Synthetic risk transfer markets have had another good year, with the core group of banks active in the market returning to issue, smaller firms mulling the market, and investors raising new cash to buy deals. But perhaps most exciting is the development of a whole new issuer base, in the shape of multilateral development banks, following the landmark ‘Room2Run’ deal between the African Development Bank and Mariner Investment Group.

-

US CLO issuance has almost entirely tapered off in the final weeks of the year, but a select few deals are crawling through the pipeline even while spreads are near recorded highs for 2018.

-

Leveraged loan prices are plummeting in secondary trading and CLO managers are scrambling to market new deals even after US equities have recovered from their recent tumble.

-

The Secured Overnight Financing Rate (Sofr), the chosen alternative to dollar Libor rates, has shown more volatility, spiking to an all-time high toward the end of last week before moving back down this week.

-

CLO market sources tell GlobalCapital that Natixis has been unable to successfully market a CLO reset on behalf of Trinitas Capital Management and will delay the offering until early 2019 as investors balk at tight spreads in a highly volatile market.

-

Defaults among borrowers with speculative grade ratings are set to dive at the start of next year, but only for a while, Moody’s said in an outlook report for non-financial corporates this week.

-

Investors in European leveraged debt seem to be giving up for the year. Funds and financial vehicles that buy high yield bonds and leveraged loans have seen large volumes of cash outflows, leaving borrowers with no other option but to step back this week.

-

Senior credit analysts at Moody’s are warning that the private equity-led proliferation of weak creditor protections in the leveraged loan market may mean a more protracted and challenging default cycle in coming years.