US Securitization

-

REIT out with 13th non-QM deal of 2025 as pipeline fills

-

Nothing Bundt Cakes starts $260m deal at low to mid 200s

-

Sarah Milam hired to boost asset-based finance

-

GSE continues efforts to reduce risk in mortgage portfolio

-

Book size about $1.7bn as non-QM deal draws steady demand

-

40bp spread pick-up potential in asset class

-

Unique, esoteric deal appeals to private credit investors' developed tastes

-

Bank premarketing 10-year conduit as supply-demand technical favors sector

-

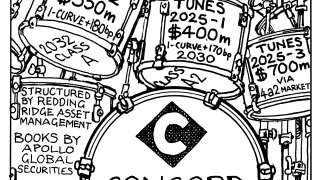

ABS paper pricing lands at I-curve plus 170bp as classic hits drive performance

-

Issuer's $652m deal — its largest of 2025 — comes in a quieter market

-

Sponsors continue to support CMBS appetite for prime office space

-

Robert Maxim has left Kroll to join Lincoln International