Latest news

Latest news

Fortress agrees forward flow for €500m of unique assets

Cash SRT pipeline fires up earlier than usual

A new European data centre sponsor, Dutch buy-to-let back in business, CLO equity squeezed and a Bitcoin backed deal

More articles

More articles

-

Italian NPL servicing specialist doBank on Wednesday announced a deal to buy 85% of Altamira Asset Management to push into other potentially lucrative southern European markets, adding €55bn in assets under management to its existing €140bn.

-

Analysts at Amherst Capital Management are predicting that the continued unwind of the Federal Reserve's holdings of Treasuries and MBS and increased deficit spending from the US government could lead to even wider spreads in credit markets throughout 2019.

-

It has been more than a decade since the US government nationalized Fannie Mae and Freddie Mac, the government-sponsored enterprises at the heart of US housing finance. Private sector advocates have hotly contested their conservatorship — without results — but 2019 be the year that that changes.

-

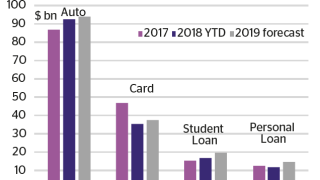

Consumer spending habits have changed beyond recognition since the financial crisis 10 years ago. US households are more wary of debt and are turning away from many of the traditional avenues of spending that have driven ABS markets for decades. While the market has come back since the depths of the crisis, securitization in 2019 is a different beast.

-

Once a big portion of global structured finance, non-agency RMBS has been a small part of the MBS market since 2008, in spite of a housing recovery in the US. Alexander Saeedy examines the outlook for a comeback of private label bonds in 2019.

-

The European Union’s new securitization regulations come into effect on January 1, a year after publication. Market participants hope they will help spark an industry revival, 10 years on from the global financial crisis. But lingering concerns could stall issuance of European ABS as 2019 gets under way.

-

Banca Carige has reduced its non-performing loan (NPL) book to €3.5bn a year ahead of schedule with a €964m NPL securitization, utilising a well tested structure that uses a state guarantee on the senior tranche.

-

The European Parliament and the European Council have reached an agreement on a set of measures to tackle non-performing loans in the banking sector, broadly backing the European Commission’s proposals from March.

-

With an eye to reducing prepayment speeds on Ginnie Mae mortgages, the U.S. Department of Veterans Affairs (VA) announced new rules on Friday that spelled out how the agency will broaden its crack down on predatory refinancing practices.