Latest news

Latest news

PRA and FCA go much further than EU in loosening rules

Liberated issuers will still have to follow European regulations if they want to sell in EU

Citi prepares consumer ABS from Abound forward flow

More articles

More articles

-

Researchers from Goldman Sachs said on Wednesday that the bank was scaling back its projected targets for year end mortgage and 10 year Treasury rates as indications of a slowing US economy and Federal Reserve dovishness suggest a gentler path upwards for interest rates.

-

Ginnie Mae, which oversees more than $2tr of US residential mortgages, has grappled with a prolonged cycle of ‘loan churning’ of Veterans Affairs loans, the steady unwind of the Federal Reserve’s balance sheet and a challenging mortgage finance market in the past year. GlobalCapital’s Alexander Saeedy connected with Ginnie Mae COO Michael Bright to discuss what lies ahead for the agency in 2019.

-

Shawbrook, a UK challenger bank advised by Bank of America Merrill Lynch and Goldman Sachs during its 2017 takeover by private equity, is waiting in the wings with a debut RMBS offering.

-

Since early November, US interest rates have slipped from multi-year highs as the benchmark 10-year Treasury fell to around 2.6%. The flattening has upended most investors’ views on fixed income performance into 2019, and in particular is drawing out concerns about a reopening of the refinancing window for mortgages originated last year.

-

A last-ditch reprieve for the asset-backed commercial paper market late last year saved European banks running securitization conduits from a huge drawing on their liquidity reserves — but details of the fix are still being hashed out.

-

Redwood Trust is preparing to issue the first private label RMBS deal of the new year.

-

Italian NPL servicing specialist doBank on Wednesday announced a deal to buy 85% of Altamira Asset Management to push into other potentially lucrative southern European markets, adding €55bn in assets under management to its existing €140bn.

-

Analysts at Amherst Capital Management are predicting that the continued unwind of the Federal Reserve's holdings of Treasuries and MBS and increased deficit spending from the US government could lead to even wider spreads in credit markets throughout 2019.

-

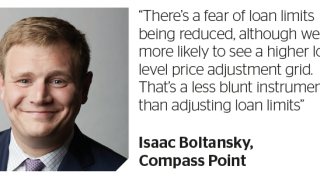

It has been more than a decade since the US government nationalized Fannie Mae and Freddie Mac, the government-sponsored enterprises at the heart of US housing finance. Private sector advocates have hotly contested their conservatorship — without results — but 2019 be the year that that changes.