-

Over the last five years I, like many of you, have spent a lot of time engaged in understanding various proposed financial reforms aimed at securitization and preparing industry responses to such proposals.

-

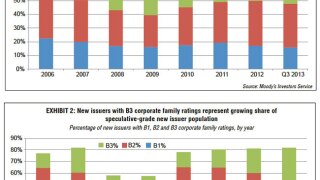

In 2014, the credit quality of new collateralized loan obligations will be strong, characterized by amortization in both the U.S. and Europe and by solid deal structures, a benign macroeconomic environment, and loosening credit in the U.S.

-

One lesson the mortgage industry learned during the recent financial turmoil: documentation matters.

-

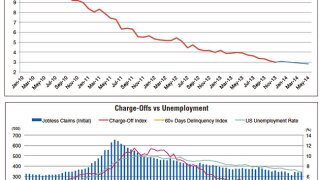

Positive U.S. macro and employment data has finally brought to bear the highly speculated tapering courtesy of the Federal Reserve.

-

Ever since the world’s first rated issuance in 2006, “trade finance securitization” has been a buzzword in the banking industry.

-

The swathe of euro-denominated issuance that has started and is expected to continue in the emerging markets ought to boost the league table positions of some of the European banks that have been breaking into these regions.

-

Conditions for issuing bonds and sukuk in Dubai look great, but mid-way through January there is still barely a glimmer of a deal. Those borrowers that need to come to market this year would do well not to miss their chance.

-

The Luxembourg government’s introduction of a sukuk bill has raised the possibility that it might stump the United Kingdom’s bid to issue the first European sovereign Islamic paper. But rather than causing alarm among UK Islamic finance practitioners, this competition for the limelight should be celebrated as a win-win for the market.

-

The United Kingdom is right to lean on Turkey for advice in placing its inaugural sukuk issue. Turkey’s experience in tapping the Islamic market was hard won and is valuable to new sovereign issuers. But the UK should prepare to pay the favour forward even if keeping its own counsel might allow it to command tighter pricing by keeping sovereign sukuk supply scarce.

© 2026 GlobalCapital, Derivia Intelligence Limited, company number 15235970, 4 Bouverie Street, London, EC4Y 8AX. Part of the Delinian group. All rights reserved.

Accessibility | Terms of Use | Privacy Policy | Modern Slavery Statement | Event Participant Terms & Conditions

Cookies Settings