-

Expect 2025 to be the year of a resurgence, as the market needs more than a couple of 25bp cuts to really stage a comeback

-

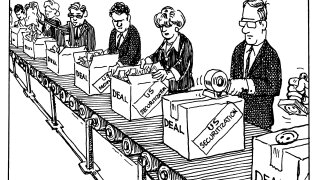

It may look opaque from the outside, but US securitization is mostly a straightforward production line providing crucial financing

-

Regulating securitization should be a matter of maximising its economic impact, not just simply preventing a crisis

-

Huge looming maturities may look scary, but the CMBS market will chip away at the wall, rather than drive into it

-

Competing issuance and volatility makes timing deals tricky

-

When markets fall out of bed, the best investment bankers still look like they sleep easy

-

Managers will need to be proactive in a market that can violently turn

-

Lower rates will give the market a boost even as other sectors curdle at the prospect of a recession

-

Sun Belt states are driving a lot of securitization, but risks are lurking in these markets

© 2026 GlobalCapital, Derivia Intelligence Limited, company number 15235970, 4 Bouverie Street, London, EC4Y 8AX. Part of the Delinian group. All rights reserved.

Accessibility | Terms of Use | Privacy Policy | Modern Slavery Statement | Event Participant Terms & Conditions

Cookies Settings