Latest news

Latest news

Layton discusses why Pearl Diver decided to enter the SRT market in late 2025, the comparison with CLOs, and how 2026 is shaping up for the CLO market with George Smith

Sub-fund will buy investment grade tranches in US and Europe

Portfolio mixes financing originated by Barings and public infrastructure debt

More articles

More articles

-

Strong demand helps riskier deals get done, but mezz guidance widened

-

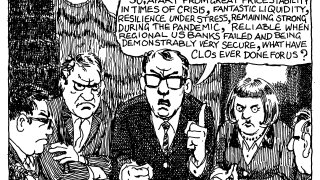

However well it does, the market cannot shake off its 'risky' tag

-

Private equity and debt firm launches deal into pipeline dominated by BSL CLO resets

-

Several managers are pushing spreads tighter through a quick succession of resets

-

After a stunning first half year, these investment vehicles are here to stay

-

Only new issue in a wave of refinancings showed the compression of manager tiering under strong demand

-

The CLO manager’s US and European platforms are run independently, but mutually benefit from each other’s relationships and greater size. By Tom Lemmon

-

Resets returning in force already as AGL pushes primary tighter but ‘all cylinders’ of demand continue to fire

-

‘Next stop sub-130bp’, says one banker as US CLO demand shows no signs of fading