Latest news

Latest news

Borrowers take advantage of robust CLO demand to tighten leveraged loan pricing

New realm for ex-Natixis banker, as HSBC Innovation Bank hires

Manager reset the deal for the second time as the end of its reinvestment period approached

More articles

More articles

-

Placing majority equity with external buyers is still unusual in Europe

-

Taking an unusual approach, the asset manager uses CLOs to finance BSL investments

-

BofA increases issuance forecast as pipeline keeps refilling

-

Stronger than expected loan supply and busy CLO issuance drives increase in prediction

-

Senior salesman to start new role in coming weeks

-

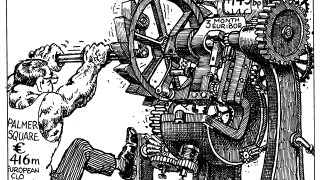

◆ UK Securitization Regulation finalised ◆ A 'flood' of CMBS ◆ Palmer Square prints tight

-

First debut manager to bring a deal this year increases all tranches amid strong demand

-

GoldenTree finally prices triple-As at tightest new issue spread of 2024

-

CLO investors have shrugged off geopolitical concerns and are focused on rates