Latest news

Latest news

Spread on triple-A rated notes 4bp wide of recent tights

Deal will bring fourth major multilateral development bank to the market

Spread on triple-A rated notes falls by 15bp compared with previous deal

More articles

More articles

-

Anticipating further deterioration in US corporate credit, KKR said it will reallocate all of its dedicated leveraged loan capital this year to an opportunistic fund that will span across corporate credit sectors.

-

As the leveraged loan market recovers following a pronounced selloff at the end of 2018, some CLO investors are eyeing a potential reboot to the flatlined CLO market if sentiment in leveraged loans remains upbeat.

-

UK banks printed a flurry of risk transfer securitizations just before the end of last year, hedging portfolios of corporate credit and commercial real estate totalling more than $8.5bn-equivalent.

-

Sidley Austin has hired Steven Koyler to join the firm’s global finance practice as a partner in New York.

-

A wave of mutual fund redemptions is pushing a loan market sell-off deeper as investors look to cash out of a potentially overheated investment, said leveraged loan market sources this week.

-

Against a backdrop of rising Libor rates, deteriorating loan covenants and strong corporate earnings, CLO participants in 2018 had to digest a host of mixed signals from the market. Investors and managers are cautiously eyeing a continued bull run as the sector comes to a late-cycle crossroads in 2019.

-

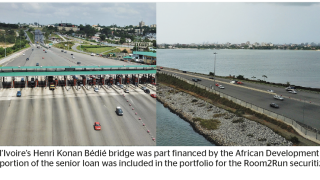

Synthetic risk transfer markets have had another good year, with the core group of banks active in the market returning to issue, smaller firms mulling the market, and investors raising new cash to buy deals. But perhaps most exciting is the development of a whole new issuer base, in the shape of multilateral development banks, following the landmark ‘Room2Run’ deal between the African Development Bank and Mariner Investment Group.

-

US CLO issuance has almost entirely tapered off in the final weeks of the year, but a select few deals are crawling through the pipeline even while spreads are near recorded highs for 2018.

-

Leveraged loan prices are plummeting in secondary trading and CLO managers are scrambling to market new deals even after US equities have recovered from their recent tumble.