US Securitization

-

Digital lender prices inside guidance but consumer data likely to start coming under greater scrutiny

-

One auto, two equipment, and one consumer loan deal were priced on Tuesday

-

Pipeline empty for August but eyes on Jackson Hole as lower rates could spur September issuance

-

Several managers are out with deals in line with last month’s levels as market rallies after early-August volatility

-

Restaurant's inaugural whole business securitization was slightly oversubscribed

-

Firm’s $501m non-QM trade arrives ahead of schedule and saw material tightening

-

Optimism is finally building amid demand for aircraft as market participants turn optimistic on 2025 activity

-

Bank starts small with its first traditional SRT but it could be a sign of things to come as investors get comfortable

-

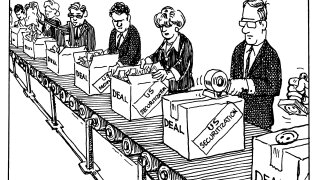

It may look opaque from the outside, but US securitization is mostly a straightforward production line providing crucial financing

-

Spreads have rallied back to the levels of two weeks ago with investors still hungry for new issues

-

Sahil Chandiramani takes more senior role after nearly four years at the fintech

-

Huge looming maturities may look scary, but the CMBS market will chip away at the wall, rather than drive into it