Latest news

Latest news

Cash SRT pipeline fires up earlier than usual

A new European data centre sponsor, Dutch buy-to-let back in business, CLO equity squeezed and a Bitcoin backed deal

€300m of reoffered bonds priced at par, another tranche to be placed privately

More articles

More articles

-

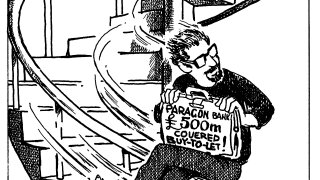

Paragon's visit to the covered bond market highlights the shoddy regulatory treatment of RMBS

-

RTL RMBS is flourishing in the US but UK still seeks daring first mover amid rating challenges, structural differences

-

Bankers weighing up new clearing levels amid constant volatility but investors still deploy cash

-

Investors push harder on mezz and subs amid economic uncertainty, rates volatility, supply surge, and new ratings methodology

-

Tight buy-to-let prints push prime tighter, as CMBS duo emerge

-

The issuer is also looking to end a six year absence from publicly placed RMBS

-

Investor base grows as attractive spread drives upsize for $879m servicer advance deal on Freddie Mac collateral

-

George Smith and Tom Hall discuss the recent run of ABS debuts, the ECB's plans to fast-track SRT approvals and bumper CLO fundraising

-

A public utility model represents the least disruptive path for Fannie and Freddie to remain as private entities