Latest news

Latest news

Nomura plans to launch its own conduit during second half of 2026

Last chance to submit nominations for yourself, your clients and peers in the GlobalCapital's US Securitization Awards

Deal represets second green securitization of a New York office tower this month

More articles

-

Barclays and Deutsche to lead deal including German collateral

-

Both parties could reassess clearing levels with investors ready to push back on spreads

-

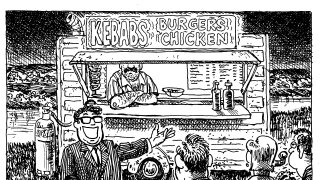

What a varied primary market menu might tell us about the state of play in European securitization

-

Issuers should learn the right lessons from Bank of America’s market-broadening deal

-

UK deal comes after BofA widens pricing on deal backed by more varied collateral

-

DB next up as policy uncertainty grows and finally bites securitized credit

-

Deals with once 'rock-solid' government exposure will face scrutiny, though structures should be resilient

-

Issuers and investors are gaining in confidence beyond the defensive logistics sector

-

BofA-MS shelf returns after 7.5 years but bankers see 'end of order padding'