Latest news

Latest news

Pricing on triple-A rated notes tightens by 15bp as manager avoids refinancing some mezzanine tranches

Lower pricing across CLO capital structure does little to improve equity arbitrage

Manager tightens triple-A pricing by 27bp and avoids refinancing some junior mezzanine notes

More articles

More articles

-

The bull market in US collateralised loan obligations showed signs of running out of steam this week. With a huge amount of supply still in the pipeline as managers try to ramp up assets under management before risk retention rules are finalised, some deals in the market are having trouble getting over the finish line after a torrid time for secondary triple-A and double-A spreads last week.

-

Onex Credit Partners, the collateralised loan obligation manager arm of Canada’s Onex Corporation, is making a push into the expanding European CLO market with a new hire, the firm announced today. The move comes amid a growing trend of US managers trying to access European investors.

-

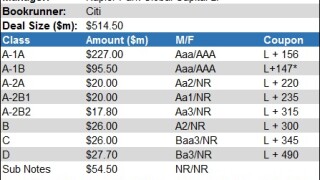

Napier Park Global Capital has priced the fifth collateralised loan obligation in its Regatta series, with the significantly wider pricing levels of the triple-A tranche showing the effect of poor secondary liquidity in senior CLO paper on primary supply.

-

Japanese investors are helping CLO managers price their deals as the end of the year approaches, filling a gap left by US triple-A investors that don’t have room left for new deals. Amid widening triple-A spreads and secondary market volatility, equity returns are suffering — but widening spreads in the underlying leveraged loan market may help offset that decline.

-

Covenant Credit Partners, which is about to price its second collateralised loan obligation, has hired a new portfolio manager to join its management team.

-

The US CLO market took a turn for the worse this week, with new issue spreads widening and a large proportion of secondary market bid lists failing to trade. Illiquidity in CLOs and a widening in the underlying leveraged loan market is now causing problems in the primary market, particularly for equity investors.

-

Guggenheim Securities has bought the European brokerage arm of Lazard Capital Markets, in a move which signals the start of the broker-dealer’s European expansion plans. The new entity will be branded Guggenheim Securities International.

-

Cantor Fitzgerald has hired a collateralised loan obligation trader in its New York office, as it seeks to build out its new issue CLO business. At the same time, it is looking to replace its head of euro CLO origination, who is no longer with the firm.

-

PineBridge Investments, a global asset manager overseeing around $73bn, has hired a veteran structured credit trader and investor with a background in CLOs as a portfolio manager in its New York office.