Latest news

Latest news

January's ABS data center deals see tenant numbers drop but demand remains strong

Deals including some commercial mortgages expected to follow

Deal was priced 6bp tighter than most recent iteration of the asset class

More articles

More articles

-

Hyundai is in the market with a $931.49m auto lease securitization, kicking things off for the primary consumer ABS market in 2017.

-

American Airlines has opened up the esoteric ABS pipeline in 2017 with a nearly $1bn enhanced equipment trust certificate (EETC) offering to fund the purchase of new aircraft.

-

The charge-off rate for prime credit cards hit a new low in December, with market watchers predicting that the sector should be able to withstand rate hikes in the coming year.

-

The introduction of a national banking charter for financial technology companies by the Office of the Comptroller of the Currency (OCC) at the end of last year will not be a big disruptor of the bank partnership model in 2017, said industry sources this week.

-

FIG issuers had a tough time navigating the primary markets in 2016, which was speckled with periods of intense volatility.

-

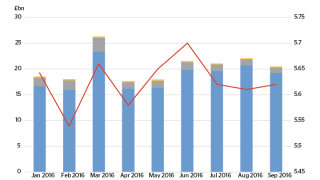

The arrival of the Bank of England’s Term Funding Scheme sparked fears that it would be the death of the UK mortgage-backed securities market. But while some bank issuers may scale back public bond plans in 2017, a sharp rally in spreads has brought new sellers into play, changing the nature of the market. David Bell reports.

-

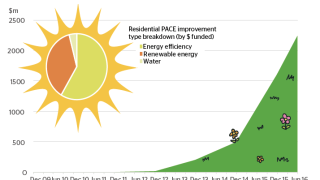

The renewable energy ABS sector had a year of sharp growth in 2016. Property Assessed Clean Energy (PACE) ABS was a strong source of bonds backed by green assets. Market players hope for a similarly successful 2017, but industry fragmentation and a new US administration may hinder growth. Sasha Padbidri reports.

-

Esoteric ABS was a focus for investors hunting for yield in 2016. The market for these assets blossomed, as issuers were lured by attractive relative value in comparison to other sources of financing. But rising interest rates, the potential for trade wars under a new US president and fits of capital markets volatility top the list of concerns for market players this year. Max Adams reports.

-

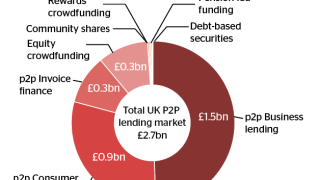

As European marketplace lending grows and matures, the sector is becoming increasingly embedded in the financial systems that it once looked to disrupt. David Bell reports.