It’s back to the future as a well-known adage re-emerges: Local currency emerging market debt is on a bull run.

Via Barclays Capital:

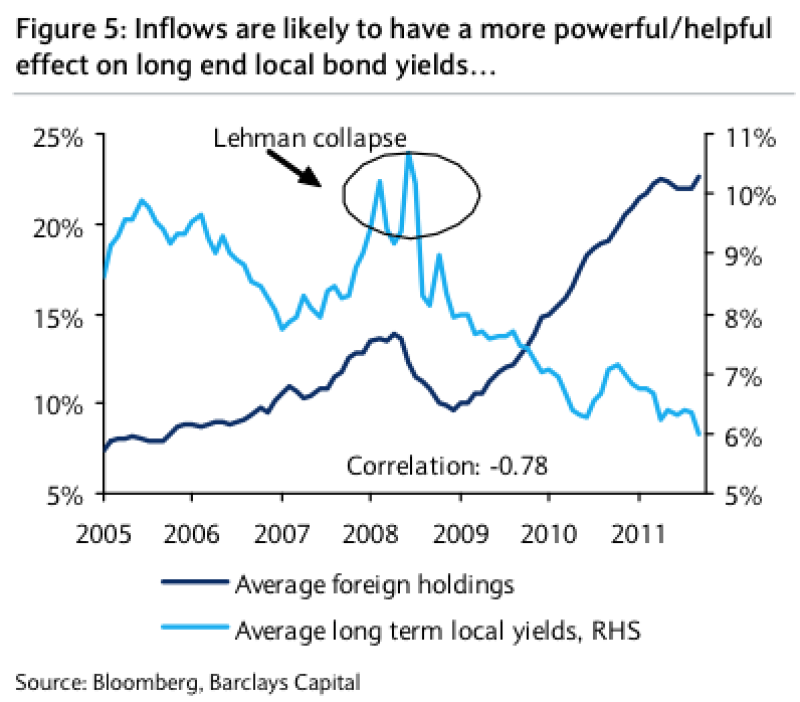

| Last week saw a slowing of portfolio flows to emerging markets, which we think is healthy given the previous rapid pace of inflows. We believe it is more appropriate to describe the current situation as one in which inflows are settling into a sustainable pace rather than it being a potential inflection point for flows and asset pricing. If the global event risks that kept investors nervous in late 2011 (fears of accelerating bank deleveraging flows and financial sector problems) remain contained, 2012 stands a good chance of resuming the long-term asset reallocation to EM local bonds. |

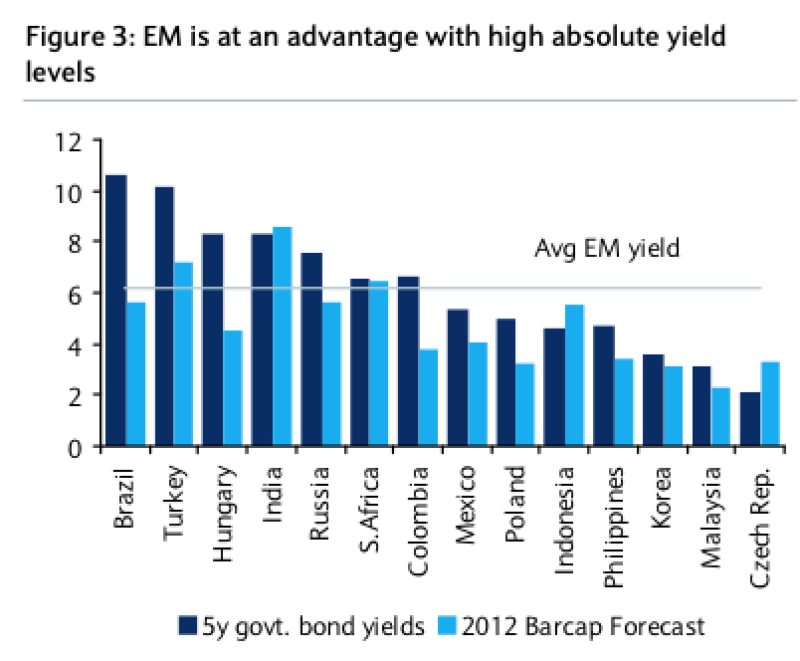

The flows, charted:

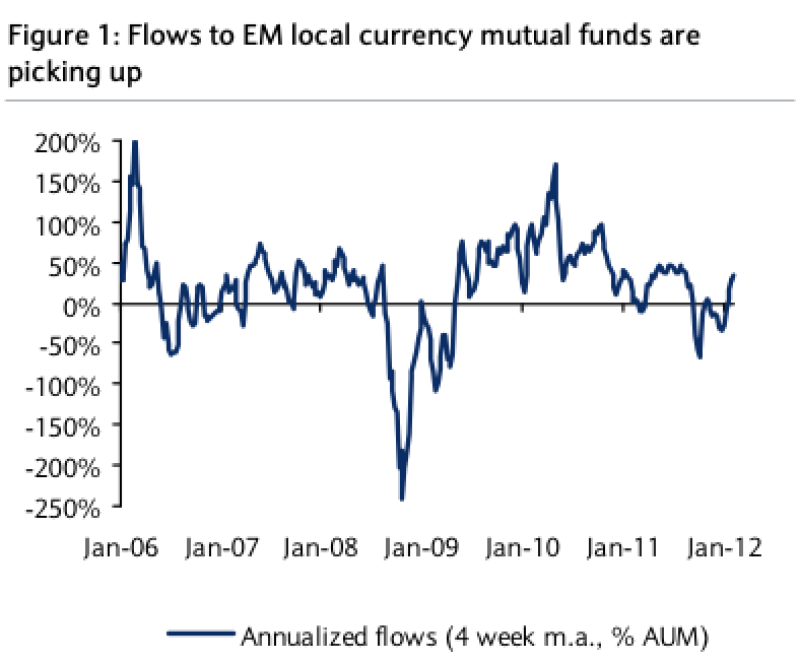

The bull run is down to a litany of factors. Higher yields – five percentage points higher on average for 5-year EM paper compared with perceived safe-havens US, Germany and Japan – for lower-leveraged sovereigns at a more buoyant stage of the business cycle; expectations for ratings upgrades; the jump in perceived creditworthiness of EMs relative to the crisis-prone eurozone and others. Technicals, such as liquidity, should improve in the medium-term as well.

The likely winners:

| These flows, in our assessment, should be particularly helpful for markets where yields are high (Brazil, Hungary, Turkey, India, Russia), where foreign investors have low exposure (India, Thailand, India and Russia), and where there may be reforms that are conducive to foreign investors becoming more actively involved in the market (Russia). Past experience suggests FX and (perhaps more so) local bond yields should benefit significantly from these inflows. |

The BarCap analysts calculate that EM bond funds (dedicated mutual and others) have grown 20% per year on an FX adjusted basis in recent years, a rate that should be sustained. The impact for currencies and yields?

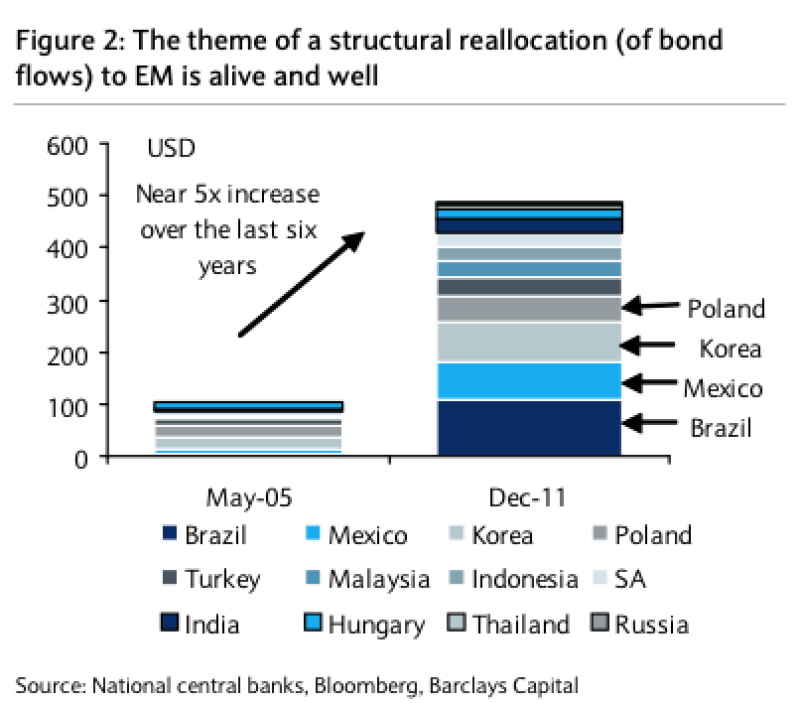

Base effects matter. Yields are likely to be compressed at greater speeds in economies where foreign ownership levels are currently low. In Russia, for example, non-residents only hold 4% of the amount outstanding, $3.8bn in nominal terms, though that should change if the government makes good on its liberalisation promise.

In general, the impact of higher foreign ownership of the local debt stock is greater on yields (lower) than on EM currencies (appreciation), according to the team.

| Marginal impact tends to be greater on yields: since 2005, there has been a -0.78 correlation between long-term local yields and the share of the local bond market owned by foreign investors. This compares with a 0.36 correlation between EM FX and the ownership ratio. |

That’s not too much of a surprise given the large number of variables that tend to effect EM FX: interest rate differentials and productivity levels, for example. And here are BarCap’s top trades:

| Our baseline scenario on EM local bonds is a constructive one and our favoured/overweight markets at the moment are India and Korea (in EM Asia), Brazil, Colombia and Mexico (in LatAm) and South Africa (EEMEA). Russia’s weight should be steadily increased in our view. The strengthening of flows to EM local bond markets should particularly favour these destinations. |

So EM debt is on an upward path, a boon for yields, and EM sovereign and corporate capital-raising efforts, more generally. But the supply question is perhaps the asset class's greatest challenge. Emerging markets are big in GDP terms but small financially-speaking. EM economies now represent roughly half of global GDP, according to the OECD. However, investable local currency fixed-income assets are relatively few and far between. As of two years ago – the latest figures we can find, though there might be more recent data - the local currency emerging market debt asset class represented $8 trillion, roughly the same size of the marketable US Treasury market. However, just over $1 trillion – overwhelmingly sovereign paper - is open for foreign investment given capital controls in the likes of India and China.

So yes, local currency sovereign debt is on a structural bull run, which will trigger yet-more dedicated funds to move determinedly into the asset class. But the large asset managers, US pension funds, for example, will find it difficult to cast EM local currency debt as anything but a source of alpha at the periphery of a given portfolio rather than a source of strategic buy-and-hold investments, representing a non-trivial portion of a given fund’s AUM.