European Securitization

-

◆ Bank treasurer speaks following after debut tier two in euros ◆ Deal reintroduces Polish tier two debt in the public euro market ◆ mBank next plans new SRT and SNP refi

-

Barclays’ trade differs from old Finsbury Square transactions

-

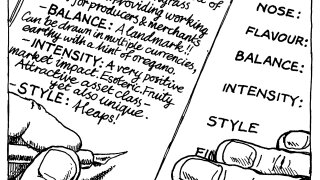

Unique, esoteric deal appeals to private credit investors' developed tastes

-

Strong order books and summer supply imply spreads will go even tighter

-

BNP also brought out a French consumer ABS

-

LiveMore had a strong result on the senior notes for its later-life RMBS

-

George Smith and Tom Hall discuss a pair of CMBS deals and whether you can trade an SRT

-

The Ophelia Master transaction has been given level 1 LCR treatment

-

Benefits aside from pricing are reasons aplenty to set up a trust

-

DBRS downgrade of the Lyon deal highlights the sector's challenges

-

Latest Wolf ABS returns to private format as Lowell continues with its balance sheet velocity programme

-

Pepper’s non-conforming trade adds some diversity to prime RMBS supply