Latest news

Latest news

Triple-As were priced at 170bp over Sofr, close to guidance

US market remains the model as template issuance takes shape

Deal is backed by three data centers in Virginia, Illinois and Atlanta

More articles

-

Credit Suisse’s EUR1.32 billion ($1.74 billion) Cornerstone Titan 2007-1 commercial mortgage securitization has seen another of its underlying loans, Star, default.

-

U.K. lender Coventry Building Society is preparing to come to market with its first securitization of prime residential mortgages, Leofric No. 1, as officials at the firm predict future RMBS activity will complement its existing covered bond program.

-

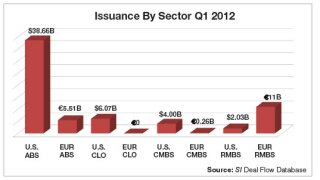

The first quarter of 2012 saw more than $51 billion of new issue securitization in the U.S. and more than $16 billion in Europe, marking the best start to a year since the 2008 financial crisis, according to SI data.

-

Class ‘A’ noteholders in Europe’s only defaulted CMBS, Opera Finance, have handed ownership of the Dutch property portfolio to private equity companies TPG Capital and Patron Capital. However, it might not set much of a precedent, said market participants.

-

Senior noteholders in Eurohypo’s troubled Opera Finance (Uni-Invest) commercial mortgage securitization this week gave the go-ahead to the proposed credit bid restructuring from private equity firms TPG and Patron Capital.

-

Widespread structural flaws in commercial mortgage-backed securities in Europe, the Middle East and Africa, particularly loans that fail to repay at maturity, expose senior noteholders to interest-rate risk, according to Fitch Ratings.

-

JPMorgan today priced its $1.1 billion public commercial mortgage-backed securities deal, JPMCC 2012-C6.

-

UBS and Barclays Capital are preparing their latest commercial mortgage-backed securities conduit issuance.

-

Less than half—47%--of loans in commercial mortgage-backed securities due to mature in March were paid off on time, according to Morningstar.