Latest news

Latest news

US market remains the model as template issuance takes shape

Deal is backed by three data centers in Virginia, Illinois and Atlanta

Tightest CMBS print in nearly a year ahead of Yondr data centre ABS debut

More articles

-

Initial price talk on Clydesdale Bank’s Lanark Master Issuer 2012-2 emerged Wednesday as the prime U.K. residential mortgage securitization reaches the final stages of the U.S. leg of its investor roadshow.

-

Ben Logan, managing director at Markit, will leave the data provider July 20.

-

London-based analysts are upbeat on the prospects for refinancing the Mall Funding commercial mortgage-backed securitization, as another of the underlying properties was offloaded.

-

A new residential mortgage-backed trade in Europe is in the works and the issuer could be under pressure to get the trade out before the summer slowdown, according to London officials.

-

Morgan Stanley and Bank of America priced MSBAM 2012-C5, a $1.3 billion commercial mortgage-backed securities conduit deal.

-

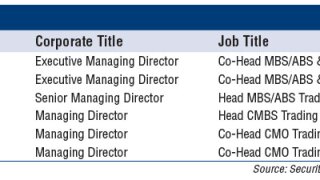

Gleacher & Company Securities, the broker/dealer arm of investment bank Gleacher & Co., has continued its senior-level hiring push.

-

Société Générale’s troubled pan-European commercial mortgage-backed trade, White Tower Europe 2007-1, has seen its class B through E notes downgraded as a result of weakening performance in the sole remaining loan.

-

Bond prices in the German Residential Asset Note Distributor (GRAND) commercial mortgage securitization have rocketed following Deutsche Annington Immobilien’s proposed restructuring of the deal.

-

Morgan Stanley and Bank of America are said to have cut the yield on a top-rated tranche of its $1.2 billion commercial mortgage-backed securities deal from up to 150 basis points above the benchmark swap rate to 135 bps, in what appears to be an effort to attract investors, which have generally been cool to such CMBS.