Latest news

Latest news

US market remains the model as template issuance takes shape

Deal is backed by three data centers in Virginia, Illinois and Atlanta

Tightest CMBS print in nearly a year ahead of Yondr data centre ABS debut

More articles

-

Fannie Mae and Freddie Mac’s issuance of multifamily commercial mortgage-backed securities rose by more than one-third in the first six months of 2012, thanks to low funding costs and strong investor demand.

-

The delinquency rate of loans in U.S. commercial mortgage-backed securities dipped slightly in June to 8.62% from 8.65% after three straight months of sizeable increases, according to Fitch Ratings.

-

Toronto-based mortgage provider First National Financial has sold C$251.6 million ($248.1 million) inmortgage backed securities set to mature in June 2017.

-

The U.S. Government Accountability Office has cast doubt on the Federal Deposit InsuranceCorp.’s ability to carry out the unwinding of systemically importantfinancial institutions under the Dodd-Frank Act’s Orderly LiquidationAuthority.

-

JPMorgan, Barclays and Bank of America Merrill Lynch continue to dominate the top three bookrunning slots, respectively, in global asset-backed securities this year, according league tables provided to SI by Dealogic.

-

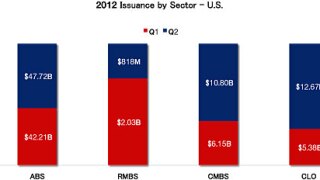

The securitization market continued to gain speed in the second quarter of 2012, surpassing the first quarter as the strongest overall for the market since the financial crisis.

-

Secondary trading volumes in Europe rounded out the week light.

-

Portfolio incomes in Barclays’ Gemini Eclipse 2006-3 are continuing to fall, sparking downgrades of the deal’s A, B and C tranches, with the deal now relying on its liquidity facility to cover investor interest payments on the notes.

-

One of Europe’s largest ever securitisations, the €4.46bn outstanding German multi-family GRAND CMBS, is a step closer to being restructured after the six largest noteholders agreed on a plan.