Latest news

Latest news

Deals including some commercial mortgages expected to follow

Deal was priced 6bp tighter than most recent iteration of the asset class

More articles

More articles

-

The deal is backed by 616 loans, most of which are underwritten without income or employment docs

-

Only mezzanine tranches offered as specialist lender brings its second deal of the year

-

- Sukuk market flying but other parts of EM in peril - What now for Turkish issuers? - SSAs dive into dollars despite debt ceiling threat - Exciting pricing in UK RMBS

-

Banking turmoil and the sales from FDIC have kept the spreads wide, creating an attractive entry point

-

Prime UK RMBS issuers take advantage of strong technicals

-

UK lender could issue covered bonds as soon as Q3 to help refinance TFSME debt

-

Tullamore court locks servicer Pepper into a 25 year fixed rate mortgage at 2.5%

-

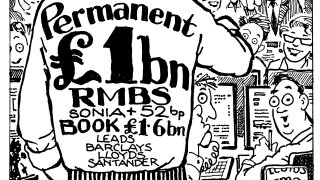

Much-anticipated £1bn deal lands at tightest level for a UK RMBS since April 2022

-

Non-agency RMBS issuance is down by 74%, with non-QM accounting for almost half