Latest news

Latest news

Nomura plans to launch its own conduit during second half of 2026

Last chance to submit nominations for yourself, your clients and peers in the GlobalCapital's US Securitization Awards

Deal represets second green securitization of a New York office tower this month

More articles

-

Issuers priced the first two conduit CMBS offerings of the year on Friday afternoon, placing the benchmark triple-A notes at considerably tighter levels compared to the last deal of 2018.

-

While capital markets recover from November and December’s year-end volatility and investors are learning to look on the bright side again, commercial real estate financiers meeting at the annual CREFC conference in Miami this week were dealing with the difficult reality of a potentially overvalued market and more competition to close deals.

-

The US commercial mortgage-backed security (CMBS) market is moving cautiously into 2019, and fears of widening spreads and shrinking market share compared to other forms of real estate debt capital are sure to be on the minds of attendees at the annual CRE Finance Council (CREFC) industry event in Miami next week.

-

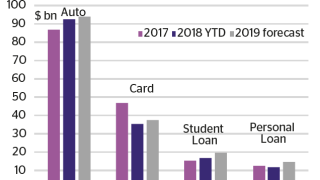

Consumer spending habits have changed beyond recognition since the financial crisis 10 years ago. US households are more wary of debt and are turning away from many of the traditional avenues of spending that have driven ABS markets for decades. While the market has come back since the depths of the crisis, securitization in 2019 is a different beast.

-

Securitization markets involve some of the most esoteric, obscure parts of investment banking. Traders and bankers rarely court publicity, while deals are placed to a specialist subset of the fixed income buy-side. Yet, 10 years after the financial crisis, securitization affects almost every part the real economy.

-

Momentum behind opportunity zones — geographic designations meant to draw in real estate investors through tax breaks — is building after the White House announced on Wednesday that it was establishing an Opportunity and Revitalization Council to foster public investments in qualified opportunity zones.

-

After snapping up around €100bn of ABS this year, investors are preparing to shut their books in the run up to year end. The last remaining CMBS deal in the pipeline — Taurus 2018-3 DEU from Bank of America Merrill Lynch — was priced on Wednesday with senior tranche demand just over the threshold and junior spreads offered at wider levels compared with initial price talk.

-

The Secured Overnight Financing Rate (Sofr), the chosen alternative to dollar Libor rates, has shown more volatility, spiking to an all-time high toward the end of last week before moving back down this week.

-

Salus European Loan Conduit No. 33 DAC, a £367m single asset CMBS, was priced last Friday with marks from Kroll Bond Rating Agency. It is the first European CMBS deal to be rated by the agency since it opened its European operation in 2017.