Latest news

Latest news

Blackstone is targeting a quicker than usual three day execution

Triple-As were priced at 170bp over Sofr, close to guidance

US market remains the model as template issuance takes shape

More articles

-

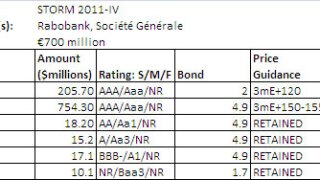

Dutch mortgage lender Obvion has priced its EUR700 million ($958.2 million) prime residential mortgage-backed deal, STORM 2011-IV, offloading the senior bonds Friday to investors at 120 basis points over three-month EURIBOR.

-

The market spent the last part of the week struggling to guess the direction of another big policy move after Federal Reserve Chairman Ben Bernanke said a third round of quantitative easing including mortgage bond buys is a viable option.

-

U.K. buy-to-let lender Paragon Mortgages will roll out more securitizations following its new £163.8 million ($261.9 million) residential mortgage-backed deal, Paragon Mortgages No. 16, Peter Shorthouse, director of treasury and structured finance at Paragon, said.

-

U.K. non-conforming residential mortgage-backed securities have been tipped as an attractive play for asset-backed securities investors, offering increasingly compelling return compared to prime paper—despite concerns about the quality of the underlying collateral.

-

The 30-day delinquency rate for commercial mortgage-backed securities rose by 21 basis points to 9.77% in October, according to Trepp.

-

The jumbo residential mortgage-backed securities sector faces a greater risk of default than its subprime counterpart, according to Moody’s Investors Service.

-

A group of more than 130 lawmakers are pressing the House of Representatives to agree to restore the higher conforming loan limit on jumbo mortgages guaranteed by Fannie Mae and Freddie Mac that was in force during the crisis.

-

Ally Financial has signaled that it would not sign-on to a proposed settlement of charges over foreclosure practices because the charges on the firm would be disproportionate to its exposure, according to Michael Carpenter, the lender’s ceo.

-

Allied Home Mortgage has been sued for allegedly engaging in fraudulent lending practices that resulted in thousands of borrowers losing their homes and costing the U.S. government more than $834 million insurance claims.