Latest news

Latest news

Blackstone is targeting a quicker than usual three day execution

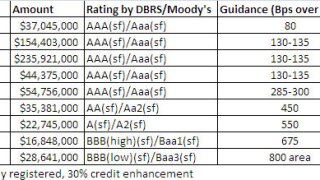

Triple-As were priced at 170bp over Sofr, close to guidance

US market remains the model as template issuance takes shape

More articles

-

Market players are reading into Ally Financial’s announcement it would no longer buy home loans in Massachusetts and wondering if there’s a next move.

-

Increased loan level data disclosure requirements for securitizations are a “red herring” and will not in themselves tempt investors back to the market, according to speakers at an industry conference in London.

-

UBS and Citigroup are preparing to market UBSC 2011-C1, a $673.9 million commercial mortgage-backed securities deal.

-

U. .S. Bankruptcy Judge James Peck has approved the liquidation plan proposed by Lehman Brothers Holdings.

-

Fitch Ratings had high praise for vintage 2001 U.S. commercial mortgage backed securities, which have weathered a recession early in their life and the recent global credit crisis in the past decade.

-

Delinquencies of commercial and multifamily loans in commercial mortgage-backed securities made modest changes in the third quarter, according to the Mortgage Bankers Association.

-

The level of transparency in certain U.K. securitization trades has been important in attracting U.S. investors to the asset class this year, but too much data could risk overwhelming potential new participants, panelists at Terrapinn’s Securitization World 2011 conference in London said Tuesday.

-

Freddie Mac has announced that it will offer another estimated $1 billion in multifamily mortgage-backed securities, also known as K Certificates.

-

The cost of foreign exchange swaps for certain U.K. firms looking to issue securitizations into the U.S. and Europe beyond the core U.K. investor base remain “prohibitively” expensive, according to Stephen Bowcott, head of securitization at Paragon Group.