Latest news

Latest news

Blackstone is targeting a quicker than usual three day execution

Triple-As were priced at 170bp over Sofr, close to guidance

US market remains the model as template issuance takes shape

More articles

-

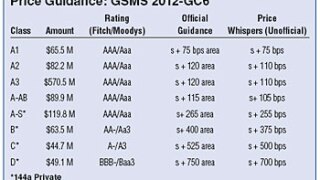

Goldman Sachs and Citigroup are planning to sell their $1.15 billion commercial mortgage-backed securities deal next week into what investors are saying will be healthy appetite, with few deals in the pipeline at the beginning of the year.

-

Santander priced the first U.K. residential mortgage-backed deal of the year, Holmes 2012-1, late Wednesday afternoon.

-

A $130.5 million loan securitized in the MLMT 2007-C1 commercial mortgage-backed securitization suffered high losses as the result of a liquidation that took nearly three years to complete, according to Barclays Capital analyst Julia Tcherkassova.

-

Fitch Ratings has downgraded 40 bonds in 25 U.S. commercial mortgage-backed securities from CCC, CC and C to D, because they incurred write-downs.

-

A loan securitized in ABN Amro’s Talisman 7 German commercial mortgage-backed securitization is now in special servicing after it failed to pay at maturity.

-

Banco BPI’s tender offer on a number of its residential mortgage-backed bonds has produced fewer buy-backs than expected, market officials in London said.

-

Investors in commercial mortgage-backed securities could stand to lose upwards of $100 million in special servicer fees stemming from loans that are only briefly serviced and in some cases never went delinquent, according to Deutsche Bank research analyst Harris Trifon.

-

Redwood Trust is preparing to tap the residential mortgage-backed securities market with the first U.S. private-label RMBS of the year: Sequoia Mortgage Trust 2012-1.

-

A loan securitized in the EUR1.5 billion ($1.9 billion) Windermere X commercial mortgage-backed deal has been fully prepaid.