Latest news

Latest news

Blackstone is targeting a quicker than usual three day execution

Triple-As were priced at 170bp over Sofr, close to guidance

US market remains the model as template issuance takes shape

More articles

-

Standard & Poor’s shakeup of senior management has continued with the removal of managing Barbara Duka as head of commercial mortgage-backed securities.

-

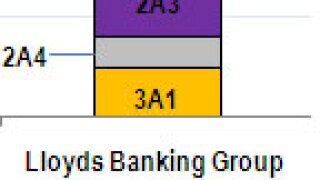

Lloyds Banking Group priced its Arkle 2012-1 U.K. prime residential mortgage-backed securitization late on Friday afternoon.

-

The GL Whole Loan, securitized in Merrill Lynch’s Taurus CMBS (Pan-Europe) 2007-1 commercial mortgage-backed deal, has been given a three-month extension to allow the borrower to arrange full repayment of the debt.

-

Only 27% of the five-year, floating-rate commercial real estate loans backing commercial mortgage-backed securities that came due in January got refinanced, causing the first wave of delinquencies for those loans, according to Trepp.

-

The tightening spreads seen in Dutch lender Obvion’s recent Storm 2012-I residential mortgage-backed trade is a reflection of growing investor confidence in Dutch RMBS, according to Max Bronzwaer, head of treasury at Obvion.

-

The Bank of Scotland has launched a tender offer to buy back three classes of notes from its Candide Financing 2005 and 2006 Dutch residential mortgage securitizations at par.

-

The volume of conduit loans in commercial mortgage-backed securities surged 515% last month from December, according to Trepp.

-

Lloyds Banking Group today issued guidance on its Arkle 2012-1 U.K. prime residential mortgage-backed issue, which includes the Arkle program’s first yen-denominated tranche since October 2010.

-

Modification of loans in European commercial mortgage-backed securities or loans in standstill rose 30.1% in January, according to Fitch Ratings.