Latest news

Latest news

Triple-As were priced at 170bp over Sofr, close to guidance

US market remains the model as template issuance takes shape

Deal is backed by three data centers in Virginia, Illinois and Atlanta

More articles

-

The EUR36.4 million ($46.8 million) Berlin residential portfolio loan, securitized in Morgan Stanley’s pan-European Silenus (European Loan Conduit) ELoC No. 25 commercial mortgage trade, has been a given a new six-month standstill period containing certain conditions.

-

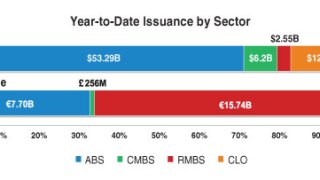

A graph of year-to-date issuance by region and sector, as reported by Securitization Intelligence, accompanied by a bird's-eye view of the activity seen in each sector last week.

-

George Smith, senior managing director in Cantor Fitzgerald’s debt capital markets platform, has left the firm to head up the mortgage-backed securities desk at Gleacher & Company Securities; the broker-dealer unit of investment bank Gleacher & Co.

-

Real estate-owned assets now account for one-third of all loan delinquencies in U.S. commercial mortgage-backed securities, according to Fitch Ratings.

-

Allied Irish Bank priced its first public securitization of residential mortgages, the £428.5 million ($691.2 million) Tenterden Funding PLC, on Wednesday.

-

President Obama recently proposed extensive government assistance to homeowners whose primary residences have fallen in value below their unpaid mortgage balances.

-

Deutsche Bank has agreed to pay more than $200 million to settle charges that it had misled the U.S. Department of Housing and Urban Development about the quality of mortgages issue by the German lender’s mortgage provider MortgageIT in 2007.

-

Standard & Poor’s has revised down by one month the timeline for clearing the U.S. residential shadow inventory.

-

Subprime residential servicer SpringLeaf Finance may file for bankruptcy if its financial condition does not improve.