Latest news

Latest news

Triple-As were priced at 170bp over Sofr, close to guidance

US market remains the model as template issuance takes shape

Deal is backed by three data centers in Virginia, Illinois and Atlanta

More articles

-

The level of bad loans held by Spanish banks rose to 8.37%, or EUR148 billion ($188 billion) in March, the highest level since September 1994, according to the Bank of Spain.

-

Spain’s Finance Ministry is said to be planning to require the nation’s banks to swap preferred shares for ordinary shares or convertible bonds and will set the swap-ratio criteria.

-

The underlying properties in the troubled £188 million ($297.4 million) Alburn Real Estate Capital 6 U.K. commercial mortgage securitization look set to be sold off.

-

Deutsche Bank and Cantor Fitzgerald are said to be preparing to sell $824 million in commercial mortgage-backed securities in the coming days.

-

Fitch Ratings has downgraded 35 bonds in 24 U.S. commercial mortgage-backed securities from C and CC to D, indicating it expects the bonds to default. Principal write-downs prompted the downgrades, says Fitch.

-

Deutsche Bank and Cantor Fitzgerald are said to be preparing to sell $824 million in commercial mortgage-backed securities in the coming days.

-

Fitch Ratings has downgraded 35 bonds in 24 U.S. commercial mortgage-backed securities from C and CC to D, indicating it expects the bonds to default. Principal write-downs prompted the downgrades, says Fitch.

-

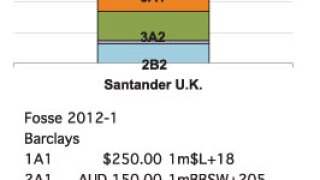

Santander U.K.’s prime residential mortgage securities deal Fosse 2012-1 has publicly sold two slices of AA-rated bonds, the first U.K. RMBS to do so since the crisis, signaling that issuers are now willing to meet buyside demand for paper further down the capital curve.

-

The Federal Reserve Bank of New York has put off a $1.67 billion sale of collateralized debt obligation holdings from its Maiden Lane III portfolio that was scheduled for today.