Latest news

Latest news

US market remains the model as template issuance takes shape

Deal is backed by three data centers in Virginia, Illinois and Atlanta

Tightest CMBS print in nearly a year ahead of Yondr data centre ABS debut

More articles

-

Holders of peripheral European asset-backed and mortgage-backed securities are said to be increasingly willing to participate in banks’ buy-backs of bonds in order to reduce their exposure to peripheral countries.

-

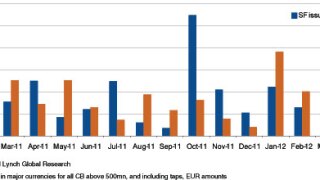

A graph of year-to-date issuance by region and sector, as reported by Securitization Intelligence, accompanied by a bird's-eye view of the activity seen in each sector last week.

-

The master servicer of the loan securitized in U.K. healthcare provider General Healthcare Group’s Theatre (Hospitals) No. 1 and Theatre (Hospitals) No. 2 transactions has appointed legal counsel for advice on the loan’s looming maturity.

-

JPMorgan is preparing its second non-performing commercial mortgage-backed securities deal of the year, according to sister publication Real Estate Finance Intelligence.

-

Dutch lender Obvion N.V. priced STORM 2012-III, its third residential mortgage-backed securities this year, Friday afternoon.

-

Recent market volatility has cooled investors’ interest in commercial mortgage-backed securities. “Holding loans on the balance sheet has become a fairly risky process,” according to Lisa Pendergast, a debt strategist at Jefferies.

-

Macro-economic concerns is sapping trading in the U.S. commercial mortgage securities market, with trading volumes and bids-wanted-in-competition both clocking in low this week.

-

JPMorgan is selling the top-rated bonds from its $270 million single-borrower commercial mortgage-backed securities deal at 50 basis points wider than original price talk, according to investors and analysts.

-

Europe’s securitization market has enjoyed strong new deal flow during May, and market officials now expect issuance volumes to overtake those of covered bonds by the end of the month, as continuing problems in the eurozone, along with bank downgrades, weigh more heavily on covered bonds than mortgage-backed securities in the region.