Latest news

Latest news

Blackstone is targeting a quicker than usual three day execution

Triple-As were priced at 170bp over Sofr, close to guidance

US market remains the model as template issuance takes shape

More articles

-

Spanish and Portuguese banks lead their European peers in buying back their own mortgage-backed securities to raise their capital, which also can serve as collateral for loans from the European Central Bank.

-

Only about one-quarter of investors in commercial mortgage-backed securities are expected to be repaid on European loans due to mature in July, according to Fitch Ratings.

-

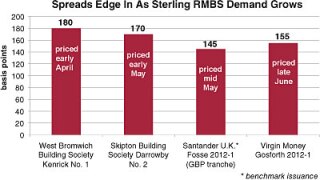

Market officials say sterling-denominated deals will be “a very important sector” in the face of sustained eurozone uncertainty during the second half of 2012, as U.K. lender Virgin Money rounded off a busy June by pricing its Gosforth 2012-1 residential mortgage-backed trade.

-

July is set to be another difficult month for CMBS, as many of the €2.5bn of maturing loans are expected to be extended, and the prospects for primary supply wane.

-

The European economic crisis has had little impact on the European structured finance sector, with a default rate of only 1.02% for vintage mid-2007 notes, according to Standard & Poor’s. S&P also reported that consumer-related securitizations have outperformed those backed by loans to corporations.

-

An estimated EUR2.5billion ($3.17 billion) in 32 loans of outstanding commercial mortgage-backed securities in Europe, the Middle East and Africa fall due in July, making it the largest monthly volume so far this year, according to Fitch Ratings.

-

Picton Property Income has agreed to long term debt facilities with insurers Aviva and Canada Life to refinance a CMBS and bilateral loan which mature next year.

-

U.S. commercial mortgage-backed securities and collateralized loan obligations have performed better than expected, while residential mortgage-backed securities and real estate collateralized debt obligations have been the worst performing among all structured finance sectors, according to Fitch Ratings.

-

Operating advisers—watchdogs appointed to safeguard the interests of investors in commercial mortgage-backed securities—are losing their clout since the positions were first created in 2009.