Latest news

Latest news

US market remains the model as template issuance takes shape

Deal is backed by three data centers in Virginia, Illinois and Atlanta

Tightest CMBS print in nearly a year ahead of Yondr data centre ABS debut

More articles

-

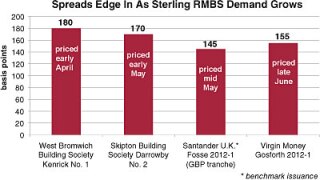

Market officials say sterling-denominated deals will be “a very important sector” in the face of sustained eurozone uncertainty during the second half of 2012, as U.K. lender Virgin Money rounded off a busy June by pricing its Gosforth 2012-1 residential mortgage-backed trade.

-

July is set to be another difficult month for CMBS, as many of the €2.5bn of maturing loans are expected to be extended, and the prospects for primary supply wane.

-

The European economic crisis has had little impact on the European structured finance sector, with a default rate of only 1.02% for vintage mid-2007 notes, according to Standard & Poor’s. S&P also reported that consumer-related securitizations have outperformed those backed by loans to corporations.

-

An estimated EUR2.5billion ($3.17 billion) in 32 loans of outstanding commercial mortgage-backed securities in Europe, the Middle East and Africa fall due in July, making it the largest monthly volume so far this year, according to Fitch Ratings.

-

Picton Property Income has agreed to long term debt facilities with insurers Aviva and Canada Life to refinance a CMBS and bilateral loan which mature next year.

-

U.S. commercial mortgage-backed securities and collateralized loan obligations have performed better than expected, while residential mortgage-backed securities and real estate collateralized debt obligations have been the worst performing among all structured finance sectors, according to Fitch Ratings.

-

Operating advisers—watchdogs appointed to safeguard the interests of investors in commercial mortgage-backed securities—are losing their clout since the positions were first created in 2009.

-

First Niagara Financial Group earned $16 million before taxes following the sale of $3.1 billion in mortgage-backed securities.

-

Achmea Hypotheekbank has priced DMPL X, its first Dutch residential mortgage-backed issue in a year, attracting strong investor demand across both tranches.