Latest news

Latest news

Blackstone is targeting a quicker than usual three day execution

Triple-As were priced at 170bp over Sofr, close to guidance

US market remains the model as template issuance takes shape

More articles

-

Bond prices in the German Residential Asset Note Distributor (GRAND) commercial mortgage securitization have rocketed following Deutsche Annington Immobilien’s proposed restructuring of the deal.

-

Morgan Stanley and Bank of America are said to have cut the yield on a top-rated tranche of its $1.2 billion commercial mortgage-backed securities deal from up to 150 basis points above the benchmark swap rate to 135 bps, in what appears to be an effort to attract investors, which have generally been cool to such CMBS.

-

Fannie Mae and Freddie Mac’s issuance of multifamily commercial mortgage-backed securities rose by more than one-third in the first six months of 2012, thanks to low funding costs and strong investor demand.

-

The delinquency rate of loans in U.S. commercial mortgage-backed securities dipped slightly in June to 8.62% from 8.65% after three straight months of sizeable increases, according to Fitch Ratings.

-

Toronto-based mortgage provider First National Financial has sold C$251.6 million ($248.1 million) inmortgage backed securities set to mature in June 2017.

-

The U.S. Government Accountability Office has cast doubt on the Federal Deposit InsuranceCorp.’s ability to carry out the unwinding of systemically importantfinancial institutions under the Dodd-Frank Act’s Orderly LiquidationAuthority.

-

JPMorgan, Barclays and Bank of America Merrill Lynch continue to dominate the top three bookrunning slots, respectively, in global asset-backed securities this year, according league tables provided to SI by Dealogic.

-

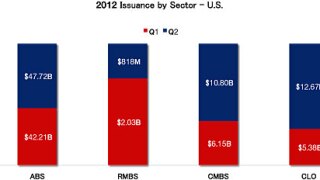

The securitization market continued to gain speed in the second quarter of 2012, surpassing the first quarter as the strongest overall for the market since the financial crisis.

-

Secondary trading volumes in Europe rounded out the week light.