Latest news

Latest news

Blackstone is targeting a quicker than usual three day execution

Triple-As were priced at 170bp over Sofr, close to guidance

US market remains the model as template issuance takes shape

More articles

-

Two loans representing 52% of the value of Talisman 6, a CMBS backed by German retail assets, have moved into default having failed to qualify for extensions.

-

A rally last week in the commercial mortgage-backed securities market is setting a positive tone for two deals in the works, according to sister publication Real Estate Finance Intelligence.

-

Initial price talk on Clydesdale Bank’s Lanark Master Issuer 2012-2 emerged Wednesday as the prime U.K. residential mortgage securitization reaches the final stages of the U.S. leg of its investor roadshow.

-

Ben Logan, managing director at Markit, will leave the data provider July 20.

-

London-based analysts are upbeat on the prospects for refinancing the Mall Funding commercial mortgage-backed securitization, as another of the underlying properties was offloaded.

-

A new residential mortgage-backed trade in Europe is in the works and the issuer could be under pressure to get the trade out before the summer slowdown, according to London officials.

-

Morgan Stanley and Bank of America priced MSBAM 2012-C5, a $1.3 billion commercial mortgage-backed securities conduit deal.

-

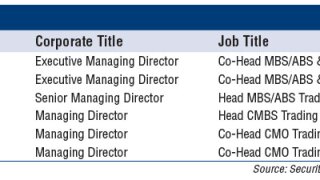

Gleacher & Company Securities, the broker/dealer arm of investment bank Gleacher & Co., has continued its senior-level hiring push.

-

Société Générale’s troubled pan-European commercial mortgage-backed trade, White Tower Europe 2007-1, has seen its class B through E notes downgraded as a result of weakening performance in the sole remaining loan.