Latest news

Latest news

Blackstone is targeting a quicker than usual three day execution

Triple-As were priced at 170bp over Sofr, close to guidance

US market remains the model as template issuance takes shape

More articles

-

The Peach loan, securitized in the German commercial mortgage-backed securitization Talisman-6, has seen its underlying asset pool value updated.

-

Two structured finance veterans who helped to kickstart broker-dealer Braver Stern’s institutional mortgage-backed securities trading platform in 2008 have left their respective firms to start retail-focused desk at a broker-dealer in New York.

-

Commercial mortgage-backed securities lending has increased in the last two weeks of August.

-

The London & Regional Debt Securitisation (LORDS) No. 1 U.K. commercial mortgage-backed deal has seen its class A and B notes downgraded by Standard & Poor’s as the single loan underpinning the deal nears maturity in October.

-

The volume of European securitization issuance could end the year down on last year’s total, Standard & Poor’s said in a study Wednesday, noting amount of issuance already placed with investors up to the end of July—EUR44 billion ($54.78 billion)—was down 10% on the same period in 2011.

-

The U.S. market was quiet last week, with a two-pronged credit card receivables deal from American Express and a quieter triple net lease deal from STORE Capital the only stories getting told.

-

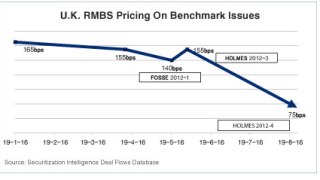

London-based officials are mulling whether the recent tightening in U.K. prime residential mortgage-backed securities has pushed spreads beneath the 110-120 to 160-170 basis points region, present since mid-2009, towards a new established tighter range.

-

There is a glut of both conduit and single asset/single borrower CMBS deals expected to hit the market next month.

-

Citigroup hired Raul Orozco as a v.p. structuring commercial mortgage-backed securities.