Latest news

Latest news

US market remains the model as template issuance takes shape

Deal is backed by three data centers in Virginia, Illinois and Atlanta

Tightest CMBS print in nearly a year ahead of Yondr data centre ABS debut

More articles

-

Commercial mortgage-backed securities lending has increased in the last two weeks of August.

-

The London & Regional Debt Securitisation (LORDS) No. 1 U.K. commercial mortgage-backed deal has seen its class A and B notes downgraded by Standard & Poor’s as the single loan underpinning the deal nears maturity in October.

-

The volume of European securitization issuance could end the year down on last year’s total, Standard & Poor’s said in a study Wednesday, noting amount of issuance already placed with investors up to the end of July—EUR44 billion ($54.78 billion)—was down 10% on the same period in 2011.

-

The U.S. market was quiet last week, with a two-pronged credit card receivables deal from American Express and a quieter triple net lease deal from STORE Capital the only stories getting told.

-

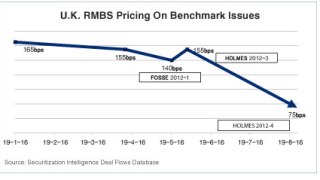

London-based officials are mulling whether the recent tightening in U.K. prime residential mortgage-backed securities has pushed spreads beneath the 110-120 to 160-170 basis points region, present since mid-2009, towards a new established tighter range.

-

There is a glut of both conduit and single asset/single borrower CMBS deals expected to hit the market next month.

-

Citigroup hired Raul Orozco as a v.p. structuring commercial mortgage-backed securities.

-

Santander U.K. has preplaced a new euro-denominated issue of prime U.K. residential mortgage-backed securities, Holmes 2012-4, and said Monday it will continue to eye funding in the public securitization market.

-

The special servicer for the Gemini (Eclipse 2006-3) CMBS, backed by Propinvest’s portfolio of UK assets, is due to speak to noteholders on Thursday to discuss its strategy, after accelerating the loan earlier this month.