The European Central Bank’s long-term repo operations (LTRO) have reduced funding stresses among major European banks, albeit with the possible side-effect of getting the banking system addicted to central bank financing. But for western bank subsidiaries in Emerging Europe, LTRO’s main effect could be to have replaced the risk of sudden death with the prospect of a drawn-out demise.

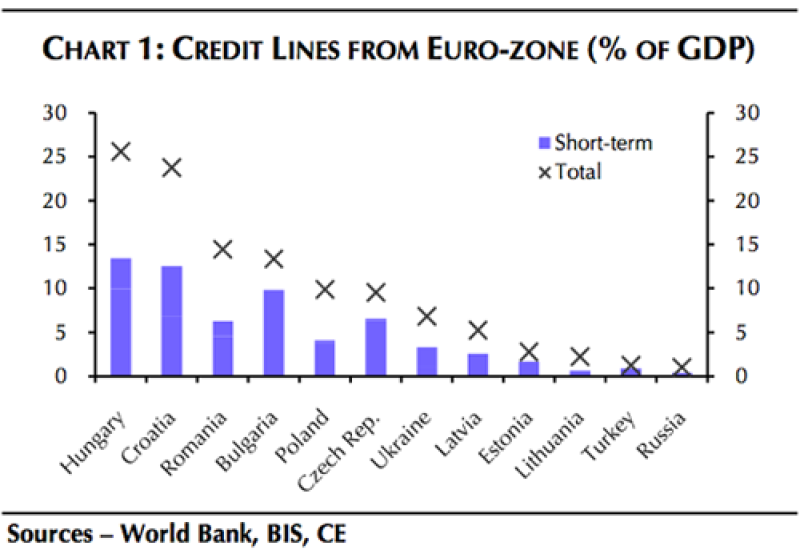

Many of Emerging European banks rely heavily on funding from their eurozone parents. Capital Economics estimates that such credit lines could account for around 25% of GDP in Hungary and Croatia, much of it short term (see chart below).

At first glance, it might seem sensible for eurozone parents to continue funding – or even to ramp up investment to –their local subsidiaries, since emerging market banks generally have better earnings growth prospects. But as the Institute of International Finance (IIF) noted in January, the expectation is for the total opposite – a steady and widespread withdrawal of western banks from emerging markets.

While regions such as Asia could see alternative sources such as Chinese and Japanese banks plug any gap, it’s less obvious that other financing will come to the rescue in Europe. The stage might therefore be set for a long period of deleveraging for central and eastern Europe’s banking sector, with knock-on effects for regional growth.

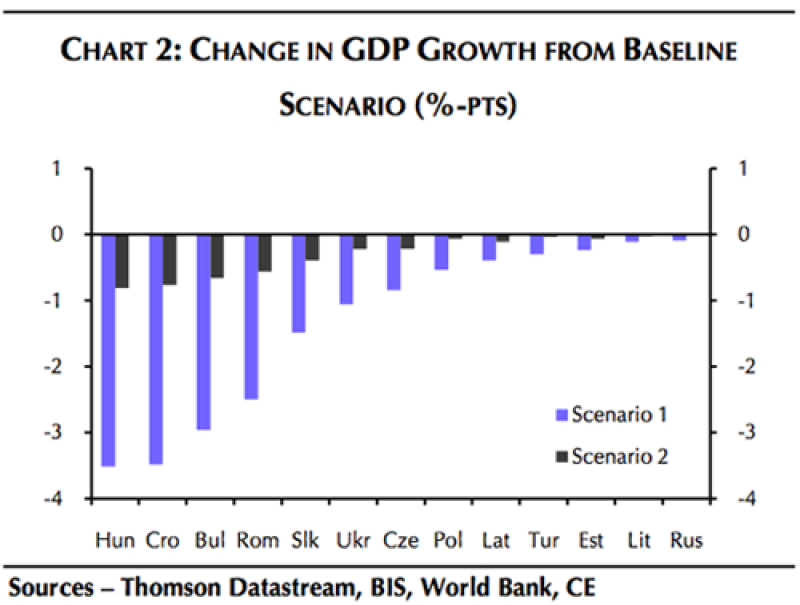

Analysts at Capital Economics have run the numbers for two such deleveraging scenarios:

| The first is a gradual withdrawal of parent bank funding, concentrated on the least profitable banking sectors. In this scenario we assume that one-third of short-term funding is withdrawn from the countries with the least profitable banking sectors over a three year period, 20% is withdrawn from mid-ranking countries, and 10% from the most profitable. The second scenario involves a more sudden pullout by euro-zone banks. Here we assume that half of the short-term credit lines to the least profitable banks in eastern Europe are withdrawn immediately, while 25% of short-term credit lines are withdrawn from mid and top-ranking banks. Of course, the ECB’s recent liquidity injections have significantly reduced the chances of this outcome (in the near-term at least). But given our view on how the euro crisis will ultimately pan out, it makes sense to think about how banks in the east might be hit in a worst case scenario. |

In the first case, the main victims are likely to be Hungary, Croatia, Bulgaria and Romania, as the first chart above suggests. In the second, almost all countries would take a notable hit, with the possible exceptions of Russia and the Baltics (although Swedish banks control and fund much of the banking system in the latter region and so these countries could be vulnerable to any transmission of eurozone problems through Sweden).

The chart below shows Capital Economics’ estimates of the hit to GDP growth under both scenarios in each economy over the respective deleveraging periods.

While a sudden cutback in parental support would constitute a severe shock, even a more measured deleveraging – an arguably optimistic scenario – could prove yet another drag on growth in much of the region for years to come.

We recently looked at reasons why the impact of LTRO on emerging markets might be more limited than some expect. Emerging Europe could be another example of where the transmission mechanism needed for LTRO to help could well be broken.