Latest news

Latest news

Nomura plans to launch its own conduit during second half of 2026

Last chance to submit nominations for yourself, your clients and peers in the GlobalCapital's US Securitization Awards

Deal represets second green securitization of a New York office tower this month

More articles

-

A consortium of banks is preparing to issue a $1.15bn single borrower CMBS deal backed by a portfolio of showroom properties owned by Blackstone.

-

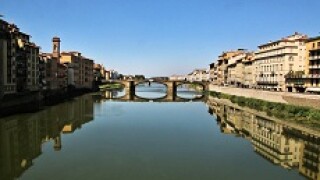

Blackstone has mandated Deutsche Bank for a €342.92m CMBS, securitizing loans on three retail and factory outlets in Northern Italy.

-

A legal battle between US private equity firm Blackstone and Italian media group RCS over an Italian CMBS will be settled in Milan, the New York state Supreme Court decided on Wednesday.

-

Bank of America Merrill Lynch's securitization research team said that they expect Italy’s NPL issuance volumes for 2019 to be lower than last year’s levels, despite the renewal of the Garanzia Cartolarizzazione Sofferenze (GACS) scheme and provisions added to encourage securitization of unlikely to pay (UTP) assets.

-

Despite a spat between the rating agencies over a French CMBS, execution on the deal looks like a blowout success, with the final senior spread tightened down to 90bp and the deal still 2.6 times done. Fitch argued that the trade should be treated as credit-linked to EDF, the only tenant, which would have capped the rating at A-, but investors disagreed.

-

A note published by two Goldman Sachs researchers this week recommended that investors go short on CMBX triple-As as the commercial real estate cycle eventually turns and spreads blow out on the CMBS bonds referenced by the index.

-

Sabal Capital Partners, a small balance commercial real estate lending company, has started a private CMBS conduit, with the aim of aggregating collateral and issuing a securitization by the end of this year.

-

The repayment of the first European multi-loan CMBS since the crisis is mired in a legal tug-of-war between Blackstone, the deal’s sponsor, and Italian media group RCS, which is chaired by Urbano Cairo, a former assistant to Silvio Berlusconi.

-

The US CMBS sector is off to a strong start in February following a slower than usual opening to the year, with issuers enjoying heavy oversubscription levels and tight spreads for deals in the market at the start of the week.