Latest news

Latest news

Nomura plans to launch its own conduit during second half of 2026

Last chance to submit nominations for yourself, your clients and peers in the GlobalCapital's US Securitization Awards

Deal represets second green securitization of a New York office tower this month

More articles

-

U.K. property investor Redefine International, sponsor of the Government Income Portfolio loan securitized in the Windermere XI U.K. commercial mortgage-backed deal, is proposing a far-reaching restructuring and extension of the loan.

-

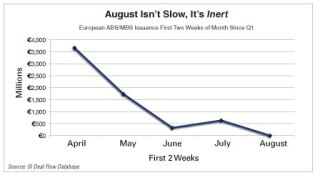

London-based officials expect the dearth of primary issuance to continue until late August, but they remain confident that new deals will surface before the month is out and be priced in the first week of September.

-

The Hugo loan, securitized in Credit Suisse’s EUR1.32 billion ($1.63 billion) Cornerstone Titan 2007-1 pan-European commercial mortgage-backed trade, has been handed a further extension until October after it was partially repaid last month.

-

Nonconforming U.K. residential mortgage-backed securities would largely be able to withstand severe stress scenarios that include all-time high unemployment, according to research from Barclays.

-

Fitch Ratings lowered its forecast for 2012 structured finance output in Europe, the Middle East and Africa by EUR75 billion ($93.19 billion).

-

Standard & Poor’s has revised the criteria it uses for rating commercial mortgage-backed securities that may result in higher ratings as it works to regain a foothold in the CMBS market.

-

The EUR11.7 million ($14.54 million) Ruhr Loan, securitized in the German commercial mortgage-backed securities transaction Taurus 2006-1 (TUARS 3), was granted an extension standstill agreement, extending the deadline for a workout from May 31 to Oct. 31, 2012.

-

The repayment date of the EUR62.7 million ($77.87 million) Nitsba loan, securitized in the commercial mortgage-backed securities deal Windermere VII, has been extended to Jan. 15, 2013.

-

Loans in Cornerstone Titan 2007-1 and Windermere VII have been given loan or standstill extensions to help property sales — further evidence of greater urgency from CMBS special servicers.