Latest news

Latest news

Nomura plans to launch its own conduit during second half of 2026

Last chance to submit nominations for yourself, your clients and peers in the GlobalCapital's US Securitization Awards

Deal represets second green securitization of a New York office tower this month

More articles

-

The U.S. market was quiet last week, with a two-pronged credit card receivables deal from American Express and a quieter triple net lease deal from STORE Capital the only stories getting told.

-

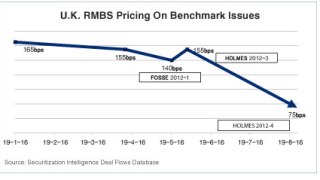

London-based officials are mulling whether the recent tightening in U.K. prime residential mortgage-backed securities has pushed spreads beneath the 110-120 to 160-170 basis points region, present since mid-2009, towards a new established tighter range.

-

There is a glut of both conduit and single asset/single borrower CMBS deals expected to hit the market next month.

-

Citigroup hired Raul Orozco as a v.p. structuring commercial mortgage-backed securities.

-

Santander U.K. has preplaced a new euro-denominated issue of prime U.K. residential mortgage-backed securities, Holmes 2012-4, and said Monday it will continue to eye funding in the public securitization market.

-

The special servicer for the Gemini (Eclipse 2006-3) CMBS, backed by Propinvest’s portfolio of UK assets, is due to speak to noteholders on Thursday to discuss its strategy, after accelerating the loan earlier this month.

-

Sabal Financial, a Newport Beach Calif.-based commercial real estate investment and advisory firm, is building out a special servicing platform targeting distressed legacy mortgages, according to sister publication Real Estate Finance Intelligence.

-

Europe’s securitization market has seen an uptick in bids-wanted-in-competition (BWIC) lists this month.

-

CBRE Servicing, the special servicer of the single loan securitized in Barclays’ Gemini (Eclipse 2006-3) U.K. commercial mortgage-backed deal, is to hold informal talks with all noteholders next week to plot out a future strategy after the loan was enforced earlier this month.